les Nouvelles February 2021 Article of the Month:

Accelerating Economic Inversion In The Post COVID-19 Economy

Co-Founder and Chief Executive Officer

Ocean Tomo, LLC

Chicago, IL (USA)

Director

Ocean Tomo, LLC

San Francisco, CA (USA)

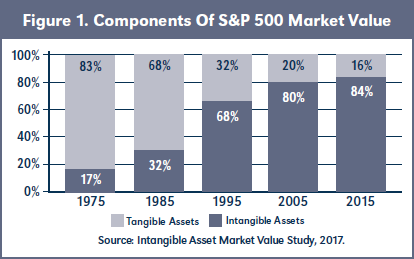

For more than a decade, Ocean Tomo has published studies documenting the growth of intangible asset value as the major component of S&P 500 market capitalization. A quarter century of data establish that the United States has transitioned from a tangible-to-an-intangible economy—a literal economic inversion or innovation revolution no less significant than the industrial revolution more than a century before. We now conclude that the economic and social shocks of COVID-19 will further accelerate this trend globally. See Figure 1.

Europe remains second only to the United States in the relative contribution of intangible assets to market capitalization and is still ahead of major Asian markets. As Europe begins to invest more in technology and the European patent marketplace, we expect a continued rise in intangible asset value and further movement to an intangible economy.1 Similarly, as Chinese companies continue to file locally and purchase more patents internationally, Chinese intangible asset market value will also change dramatically.2

As a telling example, Korea’s KOSDAQ Index has already shown an increase in intangible asset market value over the past few years. Investing in intangible assets is also becoming a priority for Japanese companies and the Japanese national government.3

As the world went into lockdown, sheltering-in-place in response to COVID-19, Ocean Tomo began to examine if coronavirus would have any impact on the above macro-economic observations. Our experience spans more than three decades and suggests that Intellectual Property (IP) is a non-correlated asset. In the short term we expect it to remain resilient during the COVID-19 driven recession. In the long run, we expect the general negative business- model impact of COVID-19 will have a positive impact on overall IP value and investment. With many countries now “reopening,” COVID-19 response will accelerate and make permanent an even more pronounced asset-light economy, one that reflects substantially reduced future investment in brick-and-mortar businesses and greater emphasis on a remote-tolerant digitalized economy. Work-at-home, online conferencing, distance education, micro-group social events and e-commerce will flourish. Reduced physical barriers to entry—and competitive response— will result in IP becoming more important as businesses seek to carve out and own their innovative footprint in the new, new economy.

COVID-19 Has Accelerated Digitalization of the Global Economy

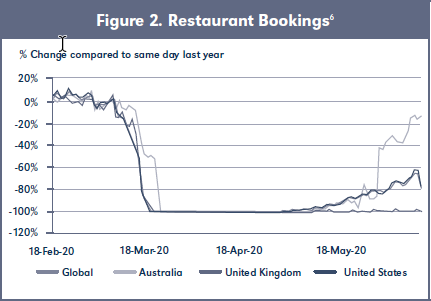

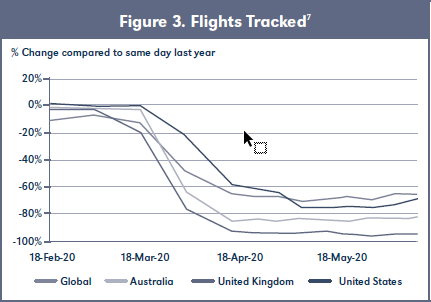

As a result of the global spread of COVID-19, countries across the world have implemented a variety of lockdown measures to contain the pandemic. In many cases the populace is still being asked to stay and work from home. Non-essential businesses remain largely shuttered and are hesitant to reopen without knowing consumer reception or in fear of a “second wave” of the virus. International travel, even within the Eurozone, has mostly ground to a halt and there has been weak economic activity in nearly every economic sector, with brick-and-mortar businesses such as restaurants, hotels, bars, retailers, tourism and leisure (e.g., airlines and movie theaters) hit the hardest.4 Economic data on the number of restaurant bookings and flights taken depict a grim economic picture.5 See Figures 2 and 3.

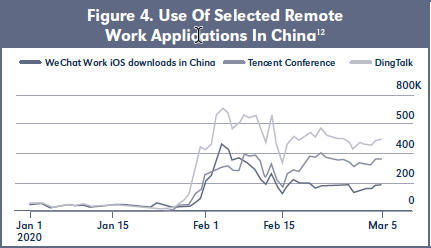

When governments, businesses and organizations began imposing travel restrictions and social distancing measures, digital solutions were the early solution to continued economic and social activity. Digitalization of the economy allowed telemedicine, telework and online education during lockdown. Online shopping grew significantly.8 As workers around the world were asked to stay home and work remotely, the demand for Microsoft Teams, Skype, Cisco’s Webex and Zoom surged. According to Microsoft, the number of users of its software for online collaboration climbed nearly 40 percent in a week as of March 23, 2020.9 Facebook’s Mark Zuckerberg reported that traffic for video calling and messaging “exploded.” 10 In China, the use of digital work applications such as WeChat, Tencent and Ding increased substantially since the end of January when lockdown measures started to take effect.11 See Figure 4.

Digitalization also allowed remote education, as the COVID-19 response in most countries did not allow for teaching in schools.13 Collectively these changes furthered a shift in consumer behavior from physical retail and service provision to electronic commerce. In the United States, online food orders, pet food, toilet paper, and medicine deliveries have seen strong growth.14 Amazon has reportedly hired 100,000 additional warehouse workers to meet the surging demand.15 Chinese online retailer, JD.com, reported that its online grocery sales grew 215 percent year-over-year during a 10-day period from the end of January to early February.16 With cinemas and theaters closed under government orders, there has been a spike in demand in movie streaming. Netflix, HBO, YouTube and other streaming services have been rapidly gaining a new audience.17 At the same time, this increase in teleworking, online conferencing, and digitalization of the economy has raised security concerns. There have been rising incidents of COVID-19 phishing scams since January 2020 and an even greater need to pay close attention to the possible security implications of the evolving use of digital tools.18

The rapid shift from physical to virtual has increased utilization of existing intangible assets and driven a heightened need for innovation to meet these ever-expanding demands. New ways of conducting business and human interaction, while maintaining safe social distancing, are being developed and supported.

Importance of IP in the Post COVID-19 World

Will the initial COVID-19 response to business operations and personal lifestyle have lasting impact? If so, how will this shape the economic inversion Ocean Tomo was tracking before the crisis? Our view is that the global economic outlook for several years will reflect consumption categories impacted by COVID-19 responsive and preventive measures. For the period spanning initial containment through full vaccination, there will be varied degrees of restrictions on social behavior and business operations. Many industries will never go back to “normal.”19 Asset-heavy brick-and-mortar consumption categories such as concerts, sporting events, movie theaters, casinos, cruises, and amusement parks pose high infection risks and will continue to be both hardest hit and slowest to recover.20

In the short term, during the COVID-19 driven economic recession, IP will remain resilient as businesses will prioritize investments in software and R&D to adjust their operational model. During previous recessions and recoveries, IP investment was less affected by the economic downturn and recovered faster than investment in equipment and structures.21 We already see some activity recognizing the importance of IP in the current COVID-19 driven recession. According to IAM, patent and related IP licensing leaders Xperi, TiVo, InterDigital and Dolby reported strong quarterly results despite the serious headwinds facing the global economy, reflecting IP as a non-correlated asset and proving its expected further value in the aftermath of a downturn.22 Digital and technology-centric sectors that have been in high demand during COVID-19, such as internet & software and technology & IT, are heavily reliant on intangible assets.23 In an annual Brand Finance GIFT™ ranking of companies based on intangible value, Microsoft, Amazon, Apple, Alphabet, and Facebook top the list, with more than 65 percent of enterprise value residing in intangible assets.24 Microsoft overtook Amazon for the top spot in the ranking for 2019, with $904B in intangible assets as the company has the largest commercial cloud business in the world.25 During COVID-19, Microsoft’s revenue in its latest quarter jumped 15 percent year-over-year to $35 billion.26

Furthermore, we believe asset-light operations will have long-lasting effect and the IP protecting such new products and services will be more important than was historically the case for business generally. The unique aspects of the COVID-19 driven recession will have a more permanent impact on IP value and intensify investment in securing technology-driven intangible assets such as patents and trade secrets.

COVID-19 is not just reinforcing technological trends that began prior to the pandemic, it is reinventing them. The pandemic reinforces a rapid adoption of contactless technologies. These technologies range from payment terminals enabling contactless payment services such as Apple Pay to Amazon Go stores, delivery drones and sidewalk robots.27 Walmart has started to remove all cashiers from the stores and offer only self-checkouts.28 According to Forbes, COVID-19 will further accelerate automation to keep human workers and consumers safe.29 An increased use of robotics, especially for healthcare screening, will be apparent due to the pandemic. New opportunities for the autonomous driving industry will also emerge. Restrictions on retail, dining, and everyday life during the outbreak have already shown an increased demand for driverless deliveries and non-contact operations, both relying on autonomous vehicle technologies.30

Artificial Intelligence (AI) has been effective in advancing public health, and the use of AI tools has been flourishing during the pandemic. Health apps with chatbots use AI to screen people for COVID-19 symptoms while COVIDScholar, developed at Lawrence Berkeley, helps biomedical researchers and clinicians to find the COVID-19 literature they need.31 AI enables teachers to rapidly develop intelligent tutoring systems, assisting in distance learning.32 Businesses have launched numerous AI initiatives to improve operations. As AI can help in developing pandemic prevention strategies, drug and vaccine development, as well as assist with remote teaching and learning and improve business operations, protecting and enforcing IP rights in AI will be essential in the post COVID-19 world.

There will be no reversion to current mechanisms of IP protection as an increasingly digitalized economy will require greater protection of user information and ensure state-of-the-art cyber security.33 Between February and May of 2020, the Department of Health and Human Services has reported an almost 50 percent increase in cybersecurity breaches in hospitals and healthcare providers’ networks.34 We anticipate that the COVID-19 crisis will further promote developments and investment in cyber security technologies such as medical devices with built-in security that can prevent breaches in real time.

The COVID-19 crisis has also accelerated the need for accurate and timely data. The government of South Korea proved this point when it worked with private companies to launch a COVID-19 data platform that reduced contact-tracing time from 24 hours in early February to less than ten minutes on March 26.35 This example highlights the importance of modernizing data architecture, reinforcing innovation, and strengthening protection of IP that is especially valuable within the information and communications technology industry.

The pandemic will redirect financial flows and lead to an increased investment by government and intelligence and healthcare sectors to manage the threat of future pandemics. Stronger environmental regulations will accelerate the transition to clean energy and boost government funding for sustainable infrastructure, energy efficiency, electric vehicles, and other low-carbon technologies. As governments around the world are trying to mitigate the consequences of the COVID-19 crisis, new metrics of economic growth (e.g., a Planetary Health Index) have emerged, showcasing different scenarios for “recovery” and a “return to normal” from policy influencers.36 With the growing importance of IP in the post COVID-19 world, we also expect to see renewed efforts at a more efficient IP marketplace and exchange.37

The coronavirus crisis has made the world exceptionally aware of the wide-ranging outcomes of interdependent global trade. We anticipate that many countries and businesses will be in search for a new supply chain concept not centered and concentrated in China. A growing national economic imperative to produce locally will result in acceleration of “smart factory technology” and “smart manufacturing” to reconfigure production chains.38 As more products will be produced via smart factories, it will be critically important to ensure that companies maximize the potential of related IP protection.

The COVID-19 pandemic will catalyze innovation and provide a supportive environment for launching and testing new ideas. As governments around the world spend tremendous resources and brainpower to find medical responses to COVID-19, such investment will result in IP value directly attributable to the healthcare industry. Technologies and innovations developed through these efforts will have an impact and use in many other economic sectors and fields as well. Based on activity already in motion, we believe that in addition to the healthcare innovation, the COVID-19 pandemic will result in accelerated developments related to data and AI, as well as supply chain, work-related and online learning technologies. With an anticipated possibility of an explosive growth in IP post COVID-19, it will be even more important to capture and protect intellectual capital and special intangible assets.

Conclusion

The impact of COVID-19 is global and affecting all sectors of the economy. While economic experts expect deepening of the COVID-19 recession and a long-lasting economic recovery, the IP landscape and environment are likely to change in a positive direction, and some economic sectors such as online education, remote working, and e-commerce are likely to benefit. The COVID-19 crisis will accelerate and assure permanence of the economic inversion driving an intensely asset-light economy. ■ Available at Social Science Research Network (SSRN): https://ssrn.com/abstract=3715018

- Cate M. Elsten and Nick Hill, “Intangible Asset Market Value Study?” September 2017.

- Cate M. Elsten and Nick Hill, “Intangible Asset Market Value Study?” September 2017.

- Cate M. Elsten and Nick Hill, “Intangible Asset Market Value Study?” September 2017.

- Hugo Erken, “Global Economic Contraction: Re-assessing the Impact of COVID-19,” April 9, 2020, https://economics.rabobank.com/publications/ 2020/april/global-economic-contraction/.

- Hugo Erken, “Global Economic Contraction: Re-assessing the Impact of COVID-19,” April 9, 2020, https://economics.rabobank.com/publications/ 2020/april/global-economic-contraction/.

- https://www.opentable.com/state-of-industry.

- https://www.statista.com/statistics/1104036/ novel-coronavirus-weekly-flights-change-airlinesregion/.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “Big Tech Could Emerge from Coronavirus Crisis Stronger Than Ever,” New York Times, March 23, 2020.

- “Big Tech Could Emerge from Coronavirus Crisis Stronger Than Ever,” New York Times, March 23, 2020.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “Big Tech Could Emerge from Coronavirus Crisis Stronger Than Ever,” New York Times, March 23, 2020.

- eMarketer, https://www.emarketer.com/content/coronavirus- china-us-covid-19-impact-retail-travel.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- Gad Levanon, Elizabeth Crofoot, and Frank Steemers, “From Appliance Repair to Amusement Parks, Which Goods and Services Will See the Biggest Drop in Business?” April 27, 2020, https://www.conference-board.org/blog/labor-markets/covid- 19-consumption-decline.

- Gad Levanon, Elizabeth Crofoot, and Frank Steemers, “From Appliance Repair to Amusement Parks, Which Goods and Services Will See the Biggest Drop in Business?” April 27, 2020, https://www.conference-board.org/blog/labor-markets/covid- 19-consumption-decline.

- Daniel Bachman and Monali Samaddar, “What Might Be Expected of Business Investment in a Post-COVID-19 World?” May 28, 2020, https://www2.deloitte.com/us/en/insights/economy/ spotlight/economics-insights-analysis.html.

- “Big Boost for Top IP Licensors,” https://www.iam-media. com/.

- Jenna Ross, “Intangible Assets: A Hidden but Crucial Driver of Company Value,” February 11, 2020, https://www.visualcapitalist. com/intangible-assets-driver-company-value/.

- Jenna Ross, “Intangible Assets: A Hidden but Crucial Driver of Company Value,” February 11, 2020, https://www.visualcapitalist. com/intangible-assets-driver-company-value/.

- Jenna Ross, “Intangible Assets: A Hidden but Crucial Driver of Company Value,” February 11, 2020, https://www.visualcapitalist. com/intangible-assets-driver-company-value/.

- Jonathan Vanian, “3 Ways COVID-19 Impacted Microsoft’s Latest Earnings,” April 29, 2020 https://fortune. com/2020/04/29/microsoft-earnings-shares-covid-coronavirus/.

- Ben Fox Rubin “Coronavirus is Making Touch-Free Shopping a Necessity,” April 15, 2020, https://www.cnet.com/ personal-finance/coronavirus-is-making-touch-free-shopping-anecessity/.

- “Walmart Looks to Remove All Cashiers From Stores,” https://www.fox5ny.com/news/walmart-looks-to-remove-all-cashiers- from-stores.

- Shahin Farshchi, “Automation In The Post-COVID-19 Economy,” April 10, 2020, https://www.forbes.com/sites/shahinfarshchi/ 2020/04/10/expect-more-jobs-and-more-automation-inthe- post-covid-19-economy/#72ad7b3829b4.

- “How Coronavirus is Accelerating a Future With Autonomous Vehicles,” The MIT Tech Review, May 18, 2020, https:// www.technologyreview.com/2020/05/18/1001760/how-coronavirus- is-accelerating-autonomous-vehicles/.

- Gary Shapiro, “How Innovation Is Helping Mitigate the Coronavirus Threat,” March 4, 2020, https://www.statnews. com/2020/03/04/innovation-mitigating-coronavirus-threat/; Matthew Hutson, “Artificial-Intelligence Tools Aim to Tame the Coronavirus Literature,” June 9, 2020, https://www.nature. com/articles/d41586-020-01733-7.

- Yan Xiao and Ziyang Fan, “10 Technology Trends to Watch in the COVID-19 Pandemic,” April 27, 2020, https://www.weforum. org/agenda/2020/04/10-technology-trends-coronaviruscovid19- pandemic-robotics-telehealth/.

- “The COVID-19 Crisis: Accentuating the Need to Bridge Digital Divides,” United Nations Conference on Trade and Development, January 2020, https://unctad.org/en/PublicationsLibrary/ dtlinf2020d1_en.pdf.

- Mallory Hackett, “Number of Cybersecurity Attacks Increases During COVID-19 Crisis,” June 4, 2020, https://www. healthcarefinancenews.com/news/number-cybersecurity-attacksincrease- during-covid-19-crisis.

- Fitzpatrick Isha Gill, Ari Libarikian, Kate Smaje, and Rodney Zemmel, “The Digital-Led Recovery From COVID-19: Five Questions for CEOs,” April 20, 2020, https://www.mckinsey. com/business-functions/mckinsey-digital/our-insights/the-digitalled- recovery-from-covid-19-five-questions-for-ceos.

- Nishan Degnarain, “Not Back But Forward: What The Post-COVID-19 Economic Recovery Models Are Getting Wrong,” April 22, 2020, https://www.forbes.com/sites/nishandegnarain/ 2020/04/22/not-back-but-forward-what-the-post-covid-19-economic- recovery-models-are-getting-wrong/#2ec9c08e7abb.

- See for example www.IPcoinGroup.com.

- Kenneth Rapoza, “These Three Things Are The Likely Legacies Of Life Post-Coronavirus,” June 14, 2020, https://www. forbes.com/sites/kenrapoza/2020/06/14/these-three-things-arethe- likely-legacies-of-life-post-coronavirus/#47ea494baf74.