Clean Tech Trends—Intellectual Property &

Transactions

Managing Director, Intellectual Energy LLC, Sedona, AZ, USA

Managing Director, MJK Partners, LLC,Cambridge, MA, USA

Clean Tech Committee

I. Introduction

The clean tech market has been going through some major changes in 2013 and the beginning of 2014. Some of the signs continue to be negative such as bankruptcies and a soft initial public offering (IPO) market but there continues to be positive trends in many areas of this sector. Overall investment in clean energy continues to be substantial and the market is re-focusing on addressing the infrastructure deficiencies that are limiting the growth of certain technologies. Renewables represent the most significant dollars invested in the clean tech sector. With the increasing volume of deployment of wind & solar resources, the need for a more intelligent and integrated electricity distribution grid has become a critical path factor. This has also further reinforced the need for cost-effective grid-scale storage technologies.

Some of the big stories were the commercial success of electric car company Tesla both in the consumer and financial markets, Google's acquisition of Nest Labs, the continued growth in the domestic production of oil and affordable and abundant natural gas and significant progress in the deployment of renewable wind and solar capacity. The increasing integration of wireless and sensor intelligence into all types of devices is creating opportunities in enterprise tools around big data and analytics.

This article is a collection of data and perspectives from thought leaders in the clean tech market looking back at 2013 and forward to what we can expect in the coming year.

II. Funding & Transactions

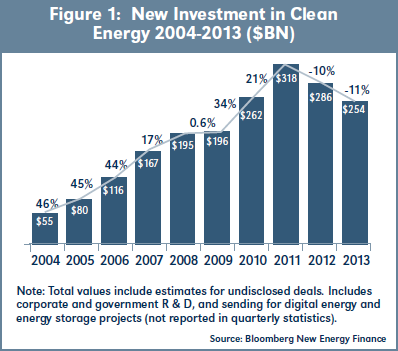

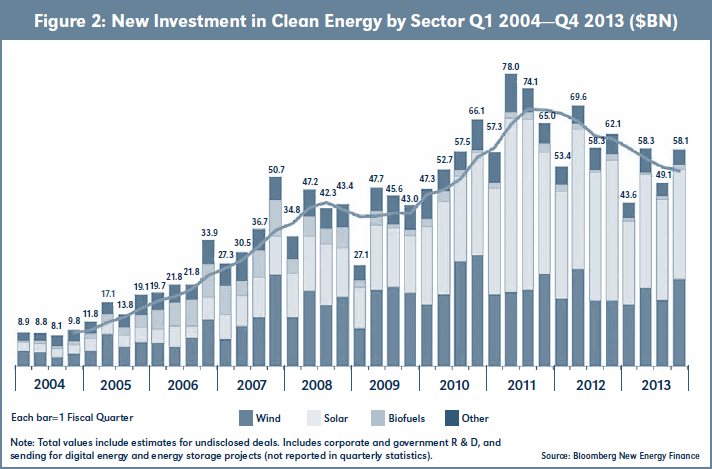

Even with the declines since the peak in 2011, global investment in clean energy continues to be substantial as shown in the Figure 1 and Figure 2 from Bloomberg New Energy Finance.1 These investment dollars are dominated by project finance for wind, solar and biofuels. These large markets for renewable projects continue to represent significant economic potential for new technologies.

Even with the declines since the peak in 2011, global investment in clean energy continues to be substantial as shown in the Figure 1 and Figure 2 from Bloomberg New Energy Finance.1 These investment dollars are dominated by project finance for wind, solar and biofuels. These large markets for renewable projects continue to represent significant economic potential for new technologies.

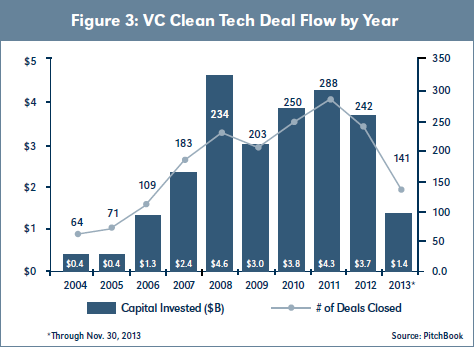

Venture capital funding, though representing a small percentage of the overall investment dollars in clean energy, is a leading indicator of innovation and the development of intellectual property in the sectors where investments are being made. After peaking in 2008, VC investments dipped significantly with the market decline in 2009 as shown in Figures 3 and 4 from PitchBook's 2013 Venture Capital Clean Tech report.2 The current slow-down in the pace of investment can be largely attributed to a retreat from the clean tech sector by many VC firms. There was a bit of a "gold rush" in the mid-2000s when traditional VC's were looking for new categories to make investments.

Clean tech looked like a sector where there was money to be made. What most investors coming out of traditional tech investing have found is that the adoption of clean tech technologies has a longer time horizon, can have a high level of regulatory complexity and in many cases is much more capital intensive than traditional high tech. Many were lured by the availability of government-backed loan guarantees and co-investment, but as we have seen with the number of high-profile bankruptcies of clean tech companies, this was not a guarantee of success.

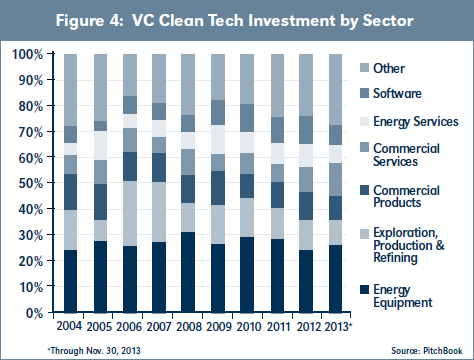

There continues to exist a committed group of venture capital investors who are comfortable with the risk profile of investing in this market and are joined by strategic/corporate investors who are looking to fuel innovation from external sources. Some VC's have narrowed their focus on categories of

There continues to exist a committed group of venture capital investors who are comfortable with the risk profile of investing in this market and are joined by strategic/corporate investors who are looking to fuel innovation from external sources. Some VC's have narrowed their focus on categories of

technology that they better understand, such as software and energy efficiency or component-level hardware technologies.

technology that they better understand, such as software and energy efficiency or component-level hardware technologies.

Government Funding And Programs

Government labs and universities continue to play an important role in both the development of clean tech technologies and IP, and as a source of funding for leading edge research and commercialization.

The ARPAe program, established in 2007 by the America COMPETES Act passed by Congress, has just released some details about their progress.3 To date, 22 ARPA-E projects have attracted more than $625 million in private-sector follow-on funding after ARPA-E's investment of approximately $95 million. In addition, at least 24 ARPA-E project teams have formed new companies to advance their technologies, and more than 16 ARPA-E projects have partnered with other government agencies for further development.

Since inception in 2009, ARPA-E has invested over $900 million across 362 projects through 18 focused programs and two open funding solicitations (OPEN 2009 and OPEN 2012). In 2013 alone, ARPA-E has launched focused programs to improve techniques to manufacture light-weight metals, develop robust battery chemistries and architectures for electric vehicles, biologically convert natural gas to liquids, create innovative semiconductor materials for improved power conversion, and use solar concentration techniques for hybrid solar converters.

The U.S. Department of Energy has taken measures to assist in the discovery and commercialization of technologies and intellectual property that have been developed in its various labs. One of those measures is the Energy Efficiency and Renewable Energy (EERE) Innovation portal.4 See Figure 5.

The U.S. Department of Energy has taken measures to assist in the discovery and commercialization of technologies and intellectual property that have been developed in its various labs. One of those measures is the Energy Efficiency and Renewable Energy (EERE) Innovation portal.4 See Figure 5.

The EERE Innovation Portal boasts innovations from twenty seven national laboratories and universities. Technology summary categories range from advanced materials to building energy efficiency and energy analysis to energy generation, industrial technology, fuels and vehicles. The database contains more than 950 technology summaries and over 18,000 patents that are available for license.

Clean Tech IPO Market:

In his article, "What the Strong IPO Market Means for Clean Tech and Renewable Energy Companies"5 Sahir Surmeli, a Partner in the Energy & Clean Technology group at Mintz Levin, writes:

"The year 2013 was officially the year with the most active IPO market in the United States since 2000. There were 222 U.S. IPOs in 2013, with a total of $55 billion raised.6 The year 2000 (over 350 IPOs) was the last year of a 10-year boom in U.S. IPOs had reached its peak in 1996 (over 650 IPOs). The strongest year for IPOs since 2000 was (until now) 2004, with roughly 215 IPOs.

What has that meant for emerging energy technology and renewables companies that might be looking to the capital markets? There was some activity in 2013—but not much compared to the broader market or to the more traditional energy and oil & gas sector.

For a handful of larger energy tech companies that are already public (e.g., Tesla, First Solar, Jinko Solar and SunEdison), it has meant follow-on offerings to bolster cash for growth. These companies accessed the market over the last several months; Tesla (May 2013), First Solar (June 2013), SunEdison (September 2013) and Jinko Solar (September 2013).

For a couple of energy companies with renewables portfolios, it has meant IPOs for "YieldCos," vehicles that hold energy-generating assets and pay a stream of dividends, such as NRG Yield (which went public in July 2013) and Pattern Energy (which went public in September 2013)." Surmeli says that he expects to see more of these in the coming years.

The Cleantech Group's i3 Investment Monitor7 noted that "significant venture exits were also realized through IPOs as 14 VC/PE-backed clean technology companies raised a total of $1.65 billion through first-time share offerings on public markets during the year. That dollar total was 19 percent higher than the $1.4 billion recorded across the 16 VCPE-backed IPOs of 2012. Notable IPOs by sector in 2013 included Silver Spring Networks (Smart Grid), Control4 (Energy Efficiency), Marrone Bio Innovations (Agriculture), Intrexon (Biofuels & Biochemicals), and Evogene (Agriculture)."

Looking forward, a recent MarketWatch.com article8 highlighted several clean tech companies that are positioning for possible IPOs in 2014.

Opower Inc., which runs energy-efficiency programs for utilities, announced on February 12th that they have submitted a confidential filing for an initial public offering. The Arlington, Va. based company has been preparing its IPO since at least last year and recently added some key people to its board of directors. Opower serves more than 90 utilities, including eight of the 10 largest in the U.S. according to its website.

Sunrun Inc., headquartered in San Francisco, is a solar-power installer, and its business model is power-purchase agreements, where users pay for the electricity and lease their PV panels rather than buying them. In June, Sunrun announced it had secured financing for more than $630 million in residential solar projects. Its main competitors are SolarCity and SunPower Corp. SPWR+2.57 percent.

Bloom Energy of Sunnyvale, Calif., makes solid oxide fuel cells around which it builds onsite power-generation systems. Its star-studded customer list includes Wal-Mart, Google and AT&T, and the firm in August started a leasing program with Bank of America Merrill Lynch.

MartketWatch analyst, Claudia Assis further comments that—"In the past couple of years, several clean-energy companies have filed and then withdrawn IPO applications. Any of them could, however, toss their hats back in the ring this year. Clean-energy and related companies that shelved IPO plans in the past include biofuel makers CosKata Inc. of Illinois, which halted its IPO process twice; Fulcrum Bioenergy of California; and Smith Electric Corp. of Massachusetts, a maker of commercial electric trucks and buses."

Global M&A And IPO Activity

The big news in clean tech M&A was the $3.2 billion acquisition of Nest by Google9 which we take a closer look at later in the article. The Cleantech Group reported that "M&A transactions targeting venture capital/private equity-backed companies in clean technology sectors totaled 83 transactions in 2013 (up 15 percent compared to 2012), of which totals were disclosed for 32 transactions totaling $604 billion (down 37 percent)."

Notable venture exits were realized in the Agriculture (Monsanto's acquisition of Climate Corporation), Energy Efficiency (NovaLED's acquisition by Samsung), Transportation (Google's acquisition of Waze) and Recycling & Waste (ecoATM's acquisition by Outerwall) sectors."10

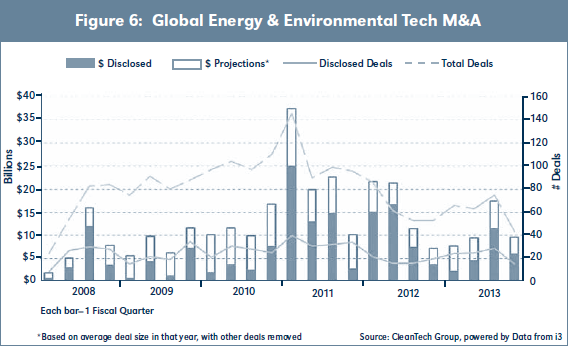

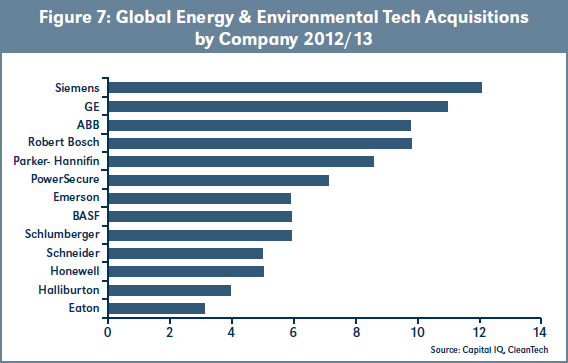

Joe Dews, a Partner at investment banking firm AGC Partners and Head of their Energy & Environmental Technologies practice, adds: "From an Internet of Things perspective, two recent transactions were quite interesting: Google/Nest highlights the value which comes from combining algorithms and endpoints, and Schneider/Invensys which combined with other past acquisitions gives Schneider very strong automation offerings across industrial, commercial building, data center and smart grid markets." See Figures 6 and 7.

Bankruptcy

Many clean tech companies continued to struggle with reaching commercial deployment and/or revenue levels to sustain their operations—resulting in the need for additional funding. As we have seen previously in this document, the pull-back of venture capital investors from this sector made it very difficult to raise additional equity financing. In some cases, strategic investors were able to step in and acquire these companies or their assets in an M&A transaction, and in other cases the companies were forced to seek bankruptcy protection.

High profile bankruptcies included electric car startup Fisker Automotive, thin film solar startup Nanosolar, solar giant Suntech, solar company Solopower, electric car startup Coda Automotive, and electric car charging company ECOtality.11

Fisker's assets were recently acquired in a bankruptcy auction by Chinese auto parts giant Wanxiang for $149 million. Wanxiang also bought up bankrupt battery maker A123 Systems in late 2012.12 These bankruptcies along with a growing number of larger companies making strategic decisions to exit markets, such as wind (UTC) and solar (BP), are creating a stockpile of orphaned technologies and IP.

III. Intellectual Property Patenting Activity

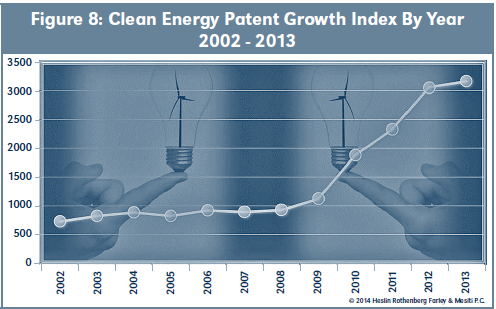

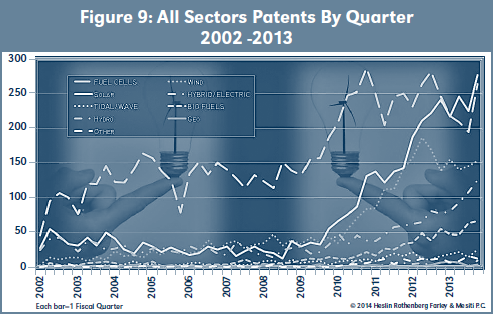

The Clean Energy Patent Growth Index13 published quarterly by Albany law firm Heslin Rothenberg Farley & Mesiti P.C., looks at where companies have been making investments in filing patents. The Index looks at patents that have been issued in nine different clean energy categories. The overall Index continues to show the strength of patents being issued, though with average time to issue in the U.S. is approximately 40 months, this can be a lagging indicator. See Figure 8 and 9.

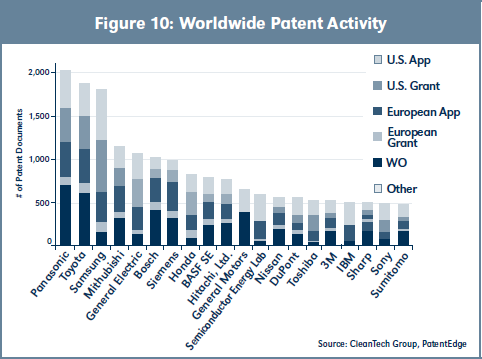

IP Checkups' CleanTech Patent Edge,14 in their comprehensive 2013 Annual Report, did some further analysis of the patenting activity in the clean tech sector. Figure 10 provides a summary of which companies are both getting new patents issued as well as filing new applications.

Though Panasonic is the most active company when looking at both U.S., European grants and WO publications, Samsung is in the top position in U.S. patent grants and application with close to 600 in each. The two categories where they have been most active are efficiency and energy storage. General Electric, with over 1,000 worldwide clean tech patents and applications, was most active in the renewable energy generation and water categories.

Some other findings:

Some other findings:

- Over 50 percent of the Top 20 Clean Tech assignees produce consumer electronics

- 20 percent of the Top 20 Assignees are auto manufacturers with various business divisions and a strong position in Clean Tech (likely from clean air initiatives).

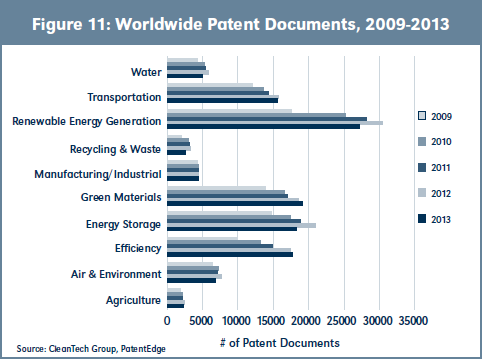

In taking a closer look at the sectors representing the clean tech market, Figure 11 shows where the bulk of the patent activity has been occurring. Renewable Energy Generation remained the #1 clean tech sector with the most patent activity in 2013. During the past 5 years, Transportation, Renewable Energy Generation, Green Materials, Energy Storage, and Efficiency related patent activity has risen.

In taking a closer look at the sectors representing the clean tech market, Figure 11 shows where the bulk of the patent activity has been occurring. Renewable Energy Generation remained the #1 clean tech sector with the most patent activity in 2013. During the past 5 years, Transportation, Renewable Energy Generation, Green Materials, Energy Storage, and Efficiency related patent activity has risen.

Litigation

In addition the litigation between Honeywell v. Nest and BRK Brands v. Nest, which are covered elsewhere in this document, there continues to be active patent disputes in the various clean tech sectors—though not at the same level as we are seeing in smartphones and other technologies.

Eric Lane, the founder and author of Green Patent Blog15 and the Principal at Green Patent Law, a boutique law firm dedicated to providing IP services to the clean tech industry had provided a summary of what's red hot in green patent litigation.

Burgeoning Biofuels Battles

Gevo-Butamax—The Gevo-Butamax litigation was a major story of 2012 and 2013, notable both for its size and as the first foray of big oil into biofuels patent suits.16 The ongoing patent litigation between advanced biofuels company Gevo and BP-DuPont joint venture Butamax has grown to encompass at least 17 suits and 14 patents relating to methods of producing biobutanol.

The lawsuit started in January 2011 with Butamax's initial complaint filed in federal court in Delaware alleging infringement of U.S. Patent No. 7,851,188 ('188 Patent), later amended to include U.S. Patent No. 7,993,889 ('889 Patent). Gevo counterclaimed, accusing Butamax of infringing U.S. Patent Nos. 8,017,375 ('375 Patent) and 8,017,376 ('376 Patent). Last year the court handed Gevo a partial victory when it granted the company's motion for summary judgment of no infringement of the '188 and '889 Patents under the doctrine of equivalents. Butamax subsequently notched a win in a decision granting its motion for summary judgment of non-infringement of the '375 and '376 Patents. As these and other big decisions start to come down, this very important battle is likely to continue. Gevo and Butamax are the two main players in isobutanol, which is a very good petroleum substitute and well-suited for both fuels and chemicals.

Novozymes-Danisco—There has been significant patent infringement litigation between Danish biopharm rivals Novozymes and Danisco (now owned by DuPont), which are both active in developing enzymes used in the production of biofuels. Novozymes has accused Danisco of infringing U.S. Patent No. 7,713,723 ('723 Patent) by selling alpha amylase enzymes including Danisco's GC358 product.

The '723 Patent, which claims priority back to an application filed in 2000, is entitled "Alpha amylase mutants with altered properties" and relates to variants of certain alpha amylases that exhibit altered stability under high temperatures, low pH and other conditions. The patented variants can be used for starch conversion in ethanol production. The case has had a number of twists and turns with both sides using a variety of legal actions.17 After a jury found in favor of Novozymes, the trial court invalidated the patent. Novozymes appealed this final decision, and last year the U.S. Court of Appeals for the Federal Circuit affirmed that the '723 Patent is invalid, in all likelihood ending the case.

Neste-Dynamic Fuels—Neste Oil's patent infringement suits against competitor Dynamic Fuels involve biodiesel fuels and production processes. Dynamic Fuels is a joint venture of Syntroleum and Tyson Foods that operates refineries capable of producing allegedly infringing synthetic renewable diesel fuels.

The patents in suit are U.S. Patent No. 8,187,344 ('344 Patent), entitled "Fuel composition for a diesel engine" and U.S. Patent No. 8,212,094 ('094 Patent) entitled "Process for the manufacture of diesel range hydrocarbons." The patent relates to a process for the manufacture of diesel range hydrocarbons from a biological feedstock where the feed is hydrotreated and isomerized. Both patents have been placed into reexam and the suits have been stayed pending the outcome.18

GS Cleantech—In another major biofuels case, involving corn ethanol production technology, GreenShift and its New York subsidiary, GS Cleantech (GS), brought a series of patent infringement suits against a host of ethanol producers across the Midwestern United States.19 Last year, GS fired off several new lawsuits involving its patented ethanol production processes against Aemetis Advanced Fuels, Southwest Iowa Renewable Energy, Little Sioux Corn Processors and Homeland Energy Solutions GS, and has been on an aggressive patent enforcement campaign over the last several years. Multiple actions were consolidated in the Southern District of Indiana, where the asserted patents were construed and re-construed.

LED Litigation

LED patent litigation continued to grow in 2013. Leading the way this past year was the Trustees of Boston University, which sued dozens of defendants including AU Optronics, BlackBerry Corporation, Dell, Fujifilm, HTC, Eastman Kodak, Olympus, Sharp, and Sony. Boston University launched about 35 new suits in 2013—they are all very similar and all assert the same patent. The patent in these suits is U.S. Patent No. 5,686,738, entitled "Highly insulated monocrystalline gallium nitride thin films" and directed to gallium nitride semiconductor devices and methods of preparing highly insulating GaN single crystal films in a molecular beam epitaxial growth chamber. The accused products include digital cameras, smart phones, and other personal electronic devices.

Nichia and Philips are perennial players in LED litigation, and both were active in 2013. On September 11, 2013 Nichia sued Everlight Electronics in federal court in Marshall, Texas for alleged infringement of U.S. Patent No. 7,432,589 ('589 Patent). The '589 Patent is directed to a semiconductor device capable of preventing an adhesive for die bonding from flowing to a wire bonding area.

In another action, Everlight sued Nichia seeking a declaratory judgment that two LED patents owned by its Japanese rival are not infringed, invalid, and unenforceable due to alleged inequitable conduct by Nichia before the USPTO. In a recent decision, a Michigan federal court granted Nichia's motion to dismiss the inequitable conduct claims. The two patents at issue relate to high brightness LED technology. They are U.S. Patent No. 5,998,925, entitled "Light emitting device having a nitride compound semiconductor and phosphor containing garnet fluorescent material" ('925 Patent), and U.S. Patent No. 7,531,960, entitled "Light emitting device with blue light LED and phosphor components" ('960 Patent) (Patents-in-suit).

Philips sued Altair in federal court in U.S. District Court for the Western District of Wisconsin requesting a declaratory judgment that U.S. Patent No. 7,049,761 ('761 Patent) is invalid and unenforceable and that Philips' LED-based replacement tube products do not infringe the patent. The '761 Patent is entitled "Light tube and power supply circuit" and directed to a light tube for a fluorescent light fixture having a plurality of light emitting diodes within the bulb. According to the complaint, Altair has been trying to get Philips to take a license to the '761 Patent. The complaint also charges Altair with a Lanham Act violation for making false or misleading representations that the '761 is a "foundational" patent and only companies that have licensed the patent can make LED-based replacement tubes for fluorescent lighting fixtures.

There are other active LED patent litigations involving major players such as Cree, LG, Nichia, Samsung and Seoul Semiconductor. More details about these can be found in LEDInside.20

Wind

In the wind market, General Electric (GE) and Mitsubishi Heavy Industries settled their long running patent litigation in December, 2013.21

The latest wind IP litigation takes place over in Europe with two major companies in wind, Enercon and Gamesa, regarding whether Enercon's very early patent on turbine control technology in high winds is valid and enforceable.22 GE is also being sued by an individual inventor over a wind turbine blade manufacturing patent in a matter GE has tried to keep very quiet.23

Licensing

Much of today's patent licensing falls under the category of enforcement & litigation. There are several examples of proactive licensing efforts/programs to patents relevant to clean tech market participants.

Several examples of such programs are:

- ISET—International Solar Electric Technology24

- Paice's Hybrid Vehicle Patents25

- Philips LED Luminaire and Retrofit Bulb

Licensing Program26 claiming over 300 licensees.

- SIPCO's Wireless Mesh Patent Portfolio

Licensing Program administered by MPEG-LA27

- Terrabon28 is licensing bio-fuel technology & IP

The energy efficiency market is making increasing use of wireless communications, sensors and big data technologies. As a result—there will be growing relevance of IP controlled by both traditional information technology companies as well as firms focused on IP licensing to product and services in the clean tech market.

IV. Sector Spotlight—Wind Patents

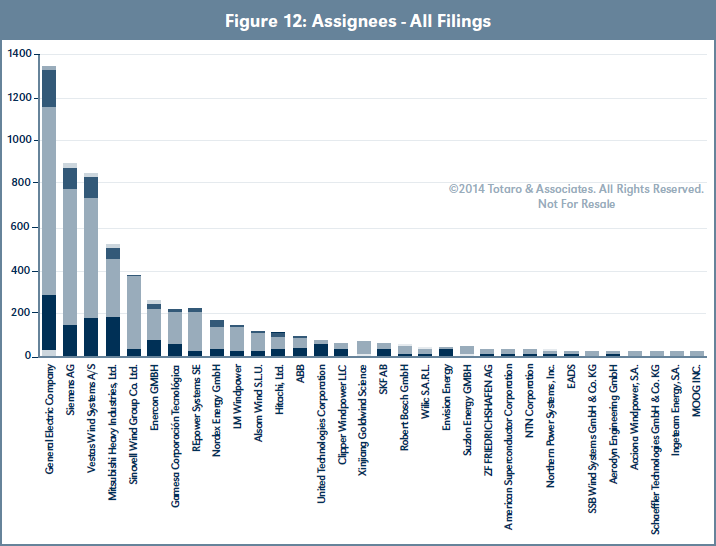

Totaro & Associates29 closely tracks the wind industry and has produced some very interesting analysis of the intellectual property landscape in this segment. The Wind Patent Landscape Report published in 2013 looks not only at the aggregate number of patents being issued to the major players in wind, it goes deeper and ranks the individual patents based on industry relevance. The chart in Figure 12 shows the leading assignees of wind patents and the color coding shows their industry relevance.

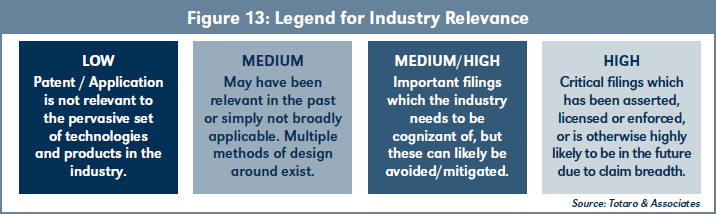

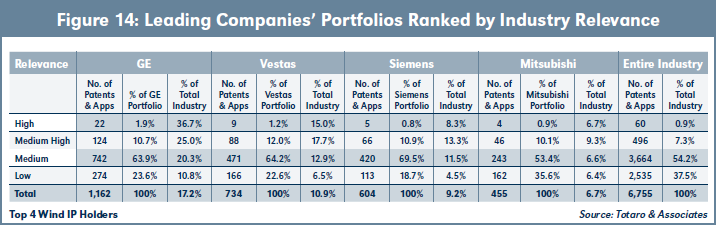

The assessment of industry relevance is based on an examination of claim breadth as well as industry usage of the patent protected technology. Backward and forward citations that should have been made, but were overlooked by the inventor(s) and / or the examiner, are identified from a thorough review of the 9,300 patent families and over 35,300 global filings in this landscape. This risk score represents the possibility or likelihood of assertion on behalf of the patent holder. In many instances, the patent holder may be unaware that their IP rights are potentially being infringed, leaving monetization opportunities to go un-exploited. See Figure 14.

Philip Totaro, Founder & CEO of Totaro & Associates observes "the industry relevance results indicate that only 1 percent of issued patents are a high impact on the entire industry as a whole, with another 7 percent which may become relevant in the future. The remaining 92 percent of filings are merely providing companies with basic defensive IP protection. This analysis is unique and very valuable not only for technology suppliers but also to insurers, project developers and financers who are interested in assessing their risk of getting swept into litigation because of the technologies they are deploying."

General Electric Company (GE) controls not only the largest number of patent families, but the largest percentage of all wind-related IP with over 17 percent of patent filings. All combined, the top 6 patent holders hold 49.4 percent of patent filings. Only 60 patent families out of 6,755 catalogued thus far comprise technology which is broadly applicable to products and services offered commercially within the industry worldwide.

Other observations on this segment are that the general practice has been one of cross-licensing vs. litigation between the major players. There has been an increasing trend of consolidation that has created some orphan technologies and patents. Assets for sale include over 230 patent families, with over 800 global filings, and all relate to technologies for horizontal-axis, utility scale wind. Companies with assets for sale include United Technologies Corporation, GE, Gamesa, Clipper Windpower, ChapDrive, Danotek Motion Technologies, Northstar Towers, CITCEA-UPC and Princeton Energy Group. As we have seen in the solar segment—the consolidation in this space had created more limited opportunities for the transfer/sale of this orphaned IP.

V. Case Study—Nest Labs, Inc.

Nest's recent acquisition by Google for $3.2 billion has been getting headlines; but one of the real stories about Nest has to do with their execution of a very effective patent strategy. Many start-ups are reluctant to dedicate significant time or resources to their intellectual property. Investors want their money to go for engineers to develop products and sales & marketing to gain customers and grow revenue. Spending precious money on legal expenses to rapidly build a patent portfolio or paying millions to acquire them is typically low on the list of priorities. Nest's patent strategy was one that appears to have been very deliberate and well played. They benefited from the fact that the founding team came from Apple where patenting is an established and important part of the culture. They knew that they would be facing challenges from established incumbents so they made sure that they raised enough capital to not only create insanely great thermostats, but also to make meaningful investments in their intellectual property.

Nest was founded in May 2010 and closed their A round of venture financing in September of that year. This is also when they filed their first few patent applications, which began issuing in late 2012 and 2013. They have continued to file applications at a steady pace.

In February of 2012, Honeywell, an established player in the residential thermostat market, filed a complaint against Nest and retailer Best Buy claiming the Nest thermostat infringed upon seven Honeywell patents.30 In July, 2013, Nest responded by filing an inter partes review (IPR) with the patent office claiming that the Honeywell patents were invalid and requesting that they be reexamined by the USPTO. The original case brought by Honeywell was stayed pending the outcome of the IPR. The initial office actions in response to the IPR were favorable to Nest with the PTO finding claims in each of the patents to be disallowed.31 Honeywell has continued to respond to these findings. In looking at the status of several of the reviews they are coming close to a conclusion. It appears all but certain that the surviving Honeywell claims, if upheld, will be significantly weaker than those found in the original granted patents.

In November 2013, BRK Brands, Inc., the makers of First Alert alarms, filed a complaint against Nest claiming that Nest's newly announced CO2 detector infringed upon seven BRK patents.32 Nest is once again taking an aggressive approach in their defense.

In addition to organic portfolio development, Nest had taken other strategic actions to bolster their IP holdings. In September 2013, Nest entered into a patent agreement with Intellectual Ventures (IV) that included a non-exclusive license to some of IV's patents and the purchase of several patent families. In looking deeper into those acquired patents, one family originated from an early energy management/home networking start up called Xanboo and another group from a defunct start up called World Theatre, Inc. In November 2013, a large portfolio of over 100 issued patents and pending applications from an individual inventor named Lawrence Kates were assigned to Nest. These patents were assigned from the law firm Knobbe Martens and had been offered for sale at the ICAP auctions in 201233 by the Stapleton Group—an asset recovery firm. This acquisition by Nest did not make the news but has added some very interesting patents and applications with priority dates as early as 2000 to their portfolio. Nest has continued to invest in the prosecution of their acquired patent families. Based on a recent search (using Thomson Innovation), their current portfolio is comprised of 92 issued U.S. utility patents, 21 U.S. design patents, and 160 U.S. and foreign applications.

The broad market acceptance of the Nest products and the exceptional team were clearly important factors in Google's desire to acquire Nest, but the value of those products and the company were significantly enhanced by their thoughtful and effective execution of their IP strategy. Nest recognized the importance of patents, especially when entering established markets where there were powerful incumbents. Now the Nest IP assets will be added to the substantial patent holdings of their well-endowed new parent Google. This is a case study that should be required reading for startup investors and management teams alike as it illustrates the importance of understanding the critical role patents play in a venture's growth and success in today's environment.

VI. Opportunities & Conclusions

The clean tech market represents a wide range of technologies. Some, such as bio-fuels, look at lot like life sciences, whereas solar and batteries are focused on materials technologies and the smart grid involves industrial controls and sophisticated software. There is massive economic value associated with the markets, such as traditional oil and gas, transportation, and energy generation and distribution.

Speakers at a recent MIT Energy Conference panel agreed that one of the limiting factors on the adoption of new technologies, especially renewables, has to do with integrating these new technologies into the electricity distribution grid. There is a lot of work going on surrounding the "integrated grid" both at groups like EPRI34 and in the organizations such as the RTO's and utilities charged with operating the grid. A recent study35 from Advanced Energy Economy shows that the category of Enabling Information and Communication Technology continues to represent the largest share of expenditures in Electricity Delivery & Management Segment with revenues of close to $30 billion. The Charging Infrastructure category, though showing investment of just over $500 million in 2013, showed the largest growth from 2011-2013 of 278 percent.

This is why technologies such as stand-alone hybrid drive systems are easier to implement and bring to market than plug-in electric vehicles (EV). The integration of renewable technologies such as wind and solar had put much greater pressure on the grid to be "smarter" and also highlighted the tremendous need for grid-scale storage solutions, not just for load balancing and voltage regulation, but also for storing the energy produced by renewable sources. This demand for energy storage continues to fuel investment in various technologies such as advanced batteries. The utility-scale energy storage market will exceed U.S. $2.5 billion in revenue by the year 2023, according to forecasting by Navigant Research,35 the research arm of consultancy Navigant.36

Even with some of the recent failures in certain markets such as solar cells, the need for more efficient sources of renewable energy generation, a more intelligent grid and smart devices, homes and cities will continue to grow. Though the global rate investment in clean tech has slowed, the patenting of intellectual property in this sector has continued to grow as had the interest from entrepreneurs and inventors. The retreat of many traditional VC's may be filled by a growing trend of crowd-funding and angel groups at the seed stage and strategic investors looking to supplement their internal R&D.

Major web and software companies such as Google and IBM are active in developing clean tech products and technologies, and large diversified multinational companies such as General Electric, Panasonic and Samsung lead the investment in new patent applications. Industry consolidation in some sectors such as wind has created opportunities for acquiring orphan IP, and new entrants will be wise to consider using Nest's playbook to compete against incumbents in established product categories.

Nest and Tesla are in the headlines, Wall Street likes solar stock such as First Solar (NASD:FSLR) and SolarCity(NASD:SCTY), and utilities are dealing with the challenges an increasing amount of renewable capacity coming online and needing to be integrated into the grid. Major opportunities remain in energy storage, energy efficiency and transportation. Though not examined in this article, the recent drought crisis in California highlights the need for progress in more intelligent use of our water resources and is a sector that is ripe for innovation. Clean tech will continue to merit attention from the Members of the Licensing Executives Society as this will continue to be an important area of focus and investment.

A special thanks to those who generously contributed to this article:

Contributors:

Claudia Assis, Analyst at Marketwatch.com

Joe Dews, Partner at AGC Partners

Eric Lane, Principal at Green Patent Law

Annemarie Meike, Business Development Exec. at

Lawrence Livermore National Laboratory

Sahir Surmeli, Partner at Mintz Levin

Philip Totaro, Founder & CEO of Totaro & Associates

Data and charts provided by:

Bloomberg New Energy Finance

Cleantech Group/i3

Heslin Rothenberg Farley & Mesiti P.C.

IP Checkups' CleanTech Patent Edge

Navigant Research

PitchBook Data

- http://about.bnef.com/fact-packs/global-trends-in-clean-energy-investment-q2-2013-fact-pack/.

- http://pitchbook.com/2013_Venture_Capital_Cleantech_Report.html.

- http://www.energy.gov/articles/arpa-e-projects-attract-more-625-million-private-funding.

- http://techportal.eere.energy.gov/.

- http://bit.ly/MWUZqa.

- Please note that there will be some variance in the statistics for IPOs generally. This is because most data sets exclude extremely small initial public offerings and uniquely structured offerings that don't match up with the more commonly under- stood public offering for operating companies. The data above is based on information from http://bear.warrington.ufl IPOs2012Statistics.pdf and Renaissance Capitalbased www.renaissancecapital.com.

- http://www.cleantech.com/2014/01/08/i3-quarterly-investment-monitor-reports-6-8-billion-cleantech-venture-investment-2013/.

- http://www.marketwatch.com/story/3-cleantech-companies-poised-to-ipo-in-2014-2014-01-08.

- http://www.bloomberg.com/article/2014-01-13/apgD_JZ-TevBg.html.

- http://www.cleantech.com/2014/01/08/i3-quarterly-investment-monitor-reports-6-8-billion-cleantech-venture- investment-2013/.

- http://gigaom.com/2013/12/31/13-biggest-moments-in-cleantech-in-2013/.

- http://www.reuters.com/article/2014/02/15/us-fisker-auction-idUSBREA1E04B20140215.

- http://cepgi.typepad.com/.

- http://www.cleantechpatent-edge.com/.

- http://www.greenpatentblog.com/.

- http://www.greenpatentblog.com/2013/08/27/butamax-avoids-infringement-of-two-gevo-patents-on-summary-judgement/.

- http://www.greenpatentblog.com/2013/08/23/novozymesdid-not-possess-claimed-biofuels-enzyme-and-is-dispossessed-of-18-million/.

- http://www.greenpatentblog.com/2013/07/29/another-nestebiodiesel-patent-suit-is-stayed-pending-reexam/.

- http://www.greenpatentblog.com/2013/09/13/clean-tech-incourt-green-patent-complaint-update-19/.

- http://www.ledinside.com/outlook/2014/1/2013_review_led_manufacturers_full_blown_patent_disputes

- http://www.bloomberg.com/news/2013-12-16/mitsubishiheavy-ge-settle-wind-patent-infringement-cases.html.

- http://www.windpowermonthly.com/article/1280923/gamesa-loses-enercon-storm-patent.

- http://www.greenpatentblog.com/2013/07/22/trigonometry-plus-non-conventional-steps-equals-eligible-subject-matter-inblade-assembly-patent/.

- http://www.isetinc.com/product-services/technologylicensing/.

- http://www.paicehybrid.com/about/our-patents/.

- http://www.ip.philips.com/licensing/led-based-luminairesand-retrofit-bulbs/.

- http://www.mpegla.com/main/programs/wirelessmesh/Pages/Intro.aspx.

- http://www.terrabon.com/.

- http://www.totaro-associates.com/.

- http://www.reuters.com/article/2012/02/06/idUS64069460520120206.

- http://www.greenpatentblog.com/2012/11/04/honeywellsmart-thermostat-patents-suffer-seven-setbacks-in-uspto-reexam/.

- http://www.theverge.com/2013/11/19/5122056/smokedetector-company-sues-nest-over-voice-alerts-and-vents.

- http://gametimeip.com/2012/03/16/is-a-lawfirm-usingicaps-patent-auction-to-recover-on-unpaid-prosecution-work/.

- http://www.epri.com/integratedgrid.

- http://info.aee.net/advanced-energy-now-2014-market-report.

- http://www.navigantresearch.com/research/advancedbatteries-for-utility-scale-energy-storage.