Venture Capital 101: Financing Mentality, Jargon, Term Sheets, And Documents

A Primer for Academic Technology Transfer Managers and Industry Licensing Executives

Osage University Partners

Founding Partner

Bala Cynwyd, PA

McCausland Keen & Buckman,

Shareholder

Radnor, PA

This article originally appeared in the March 2014 issue of les Nouvelles.

Introduction

With the heightened attention of senior academic administrators to promoting economic development and fostering innovation ecosystems, academic technology transfer organizations are increasingly focusing their commercialization activities on identifying, qualifying, incubating, accelerating, and financing start-up ventures. This top down pressure is aligned with bottom up pressure from faculty researchers who, albeit for different reasons, are likewise increasingly interested in the impact of their discoveries and seeking to commercialize them through start-ups. Moreover, technology managers are now thrust into new roles, such as creating pre-license value, recruiting investable management, raising capital, and positioning licensed technology to become part of a commercially successful product in a thriving company. Likewise, for a variety of reasons, industry licensing executives are increasingly out-licensing de-prioritized corporate R&D projects to start-up ventures. Like their academic counterparts, industry licensing executives find themselves dealing with financing and other new venture business development issues. Technology managers and industry licensing executives now need to understand the mentality of venture capitalists and other institutional investors and become fluent with their jargon, term sheets, and documents. This article seeks to demystify venture capital ("VC") start-up dealmaking.

Background

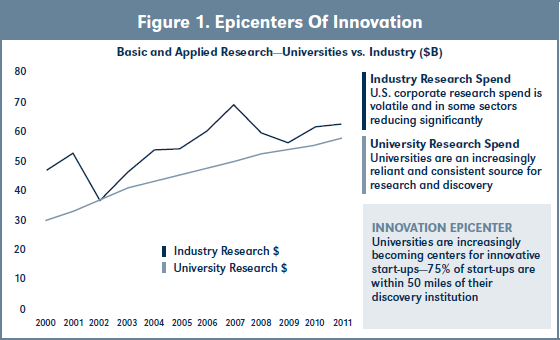

Not-for-profit research institutions continue to be epicenters of innovations as envisioned in the virtuous cycle of technology transfer and commercialization in 1945 by Vannevar Bush in Science, the Endless Horizon.1 While the U.S. corporate research spend has been volatile, and even decreasing, federal funding for basic research in academe has grown steadily and significantly. See Figure 1.

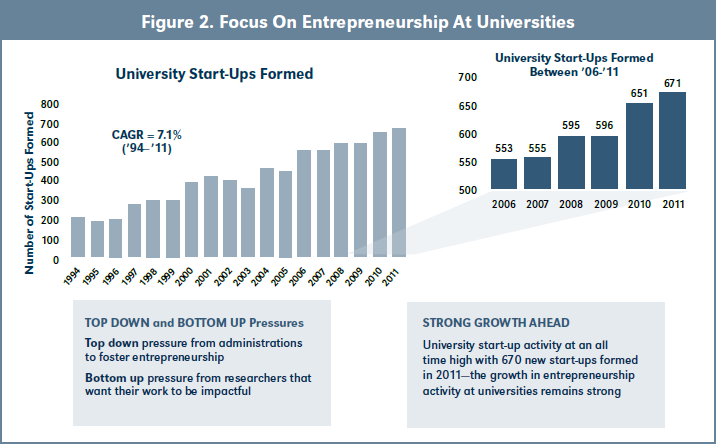

University start-ups are the epitome of Bush's virtuous cycle vision as approximately 75 percent of them locate within 50 miles of their discovery source.2 University start-up activity is at an all time high with 670 new ventures formed in FY2011.3 See Figure 2.

Technology managers ("TMs") at academic institutions, including teaching hospitals and non-profit research institutions, have become increasingly adept at all aspects of the technology transfer and commercialization process:

- Creating an innovation ecosystem;

- Establishing and maintaining positive and productive relationships with faculty, administrators, and civic leaders involved in the innovation ecosystem;

- Ferreting research discoveries addressing unmet needs and possessing commercial potential;

- Assessing technology disclosures and business development opportunities (triage) for technical merit, commercial potential, protectability, and inventor profile;

- Working with outside counsel to prepare, file, prosecute, maintain, and enforce patents and patent applications;

- Marketing licensing opportunities;

- Negotiating term sheets and license agreements;

- Creating and managing various types of innovation funds (proof-of-concept, seed, and growth);

- Selecting, developing, and launching start-up ventures and establishing and maintaining relationships with institutional investors;

- Managing equity in start-ups; and

- Maintaining relationships and license agreements with licensees.

While these efforts are beneficial, it is also true that success in academic technology transfer is often a function of world-class investigators with substantial research funding working cooperatively with their industry counterparts and venture investors. Furthermore, successful academic technology transfer is also a function of diligence, perseverance, patience (managerial longevity and continuity), an enlightened administration, and luck.

TMs "know" but find it difficult if not impossible to act on what they know about launching successful start-ups. Research confirms what experienced startup business development ("SUBD") TMs know—academic start-ups managed by industry experienced entrepreneurs who secure venture capital funding are more likely to be successful than companies led by faculty and graduate students moonlighting as entrepreneurs and capitalized solely with funds from friends and family, angel, and research grants.4 The study notes that respondents confirm that venture capitalists are not only important sources of funding, but that they also provide mentoring and networking services and technical expertise important to start -ups and that faculty with industry consulting and prior entrepreneurial and industrial experience better understand markets and technology development.

Venture Capital Mentality

TMs' and industry licensing executives' SUBD knowledge, skills, and attitudes have progressed substantially in recent years. Increasingly, technology licensing offices ("TLOs") are employing individuals in SUBD functions who have training in venture capital. However, experience indicates that TMs without such experience have, at best, only a modest understanding of venture capital. Much of the same can be said about industry licensing executives, albeit their typical backgrounds (commercial, technical, and/or legal) and work experiences may provide a more relevant base.

As a first principle, venture capitalists ("VCs") seek to finance potentially transformative companies based on a disruptive (platform) technology (secret sauce) represented by a lead materially differentiated product in a substantial market that addresses a compelling unmet need. Ideally, the company is led by industry experienced chief executive officer ("CEO") and management team. Indeed, all of these are essential elements–secret sauce, market opportunity, product differentiation, and management5 – are required.

However, even these essentials elements may not be sufficient to generate a "yes," positive investment decision. It is far easier, less risky, and human resource conserving for a venture capitalist to say 'no,' to 'pass' and not do a deal, than to invest in one. In fact, venture investors consider hundreds of opportunities, many with superior technology and commercial potential and with all of the essential elements enumerated above, for each deal in which they do make an investment.

Further, VCs often exhibit lemming-like behavior— they tend to follow the crowd.6 Discovery institutions and organizations are advised to monitor investment behavior as sector tailwinds and headwinds change frequently.

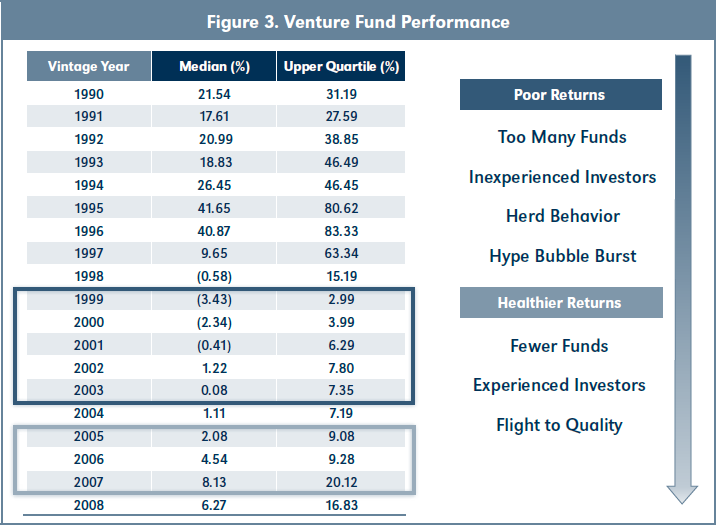

While investment sectors have come in and out of favor, venture fund performance during the past two decades has been a roller coaster. 1999-2003 vintage funds have produced poor returns. More recent funds have produced healthier returns. As a result, both the number of funds and the size of funds have contracted (some observers would say they have been 'right sized'). See Figure 3.

The Essential Elements

Management is Paramount

Recognizing the earlier caveat about prospects for obtaining institutional financing in the absence of industry experienced management for early/discovery stage technologies, management is essential in generating a positive investment decision, especially for later stage opportunities. Analogous to real estate's mantra of "location, location, location," in venture capital, the slogan is "management, management, management"! So, what constitutes investable management? Experience indicates that complete assembly investable CEOs possess a variety of characteristics and that there is no unique, prescriptive description. However, the following characteristics are evident in most successful CEOs of venture backed start-ups:

- Ideally, the CEO is already known to potential institutional investors and has made money for investors in the past or has been referred by a trustworthy colleague or friend and has a track record of effectively managing finances to a successful exit for investors;

- An investable CEO is able to tell "the story" effectively, that is, able to share a vision of the company in an interesting and compelling manner;

- Fundable entrepreneurial CEOs also exhibit certain personal characteristics including, intelligence, persistence, resilience, selfawareness, open-mindedness, the ability to learn, and a manageable ego;

- Investable CEOs have a relevant commercial background and experience; they understand the market and what customers need, want, and are willing to buy; in positioning the company, the CEO shares data indicating why customers will be interested in the product/ service and speak authoritatively about the market from personal experience.7,8

Experienced business development executives understand the imperative of an investable CEO and management team. But, management teams with different backgrounds and skills are required at different stages of the life cycle of venture-backed companies. Many science-driven and science-focused discovery, seed, and early stage ventures may not need a full-time industry-experienced CEO. Rather, these nascent companies may need a great chief scientific officer and business development or chief business officer. Anointing either the chief scientific or business development officer as the future CEO can create organizational challenges downstream. Keeping the CEO role intentionally vacant and allowing the investing VCs to recruit the CEO can minimize future organizational disruption.

If the secret sauce (technology, platform, product, IP) in the deal is the horse, then the CEO is the jockey. VCs bet on jockeys riding horses with great pedigrees and huge potential. Even the most interesting opportunity (i.e. horse), without an able CEO (jockey) is not likely to be investable (unless the investor is able and willing to change management at the outset or near-term) if the team fails to perform as predicted. As part of the management consideration component of an investment decision for a science-driven venture, investors are also concerned with the role founding scientists will play in the new company and whether their incentives and rewards are aligned with investors. Investors are also concerned that founding scientists serving in management and fiduciary roles may be too focused on proving the technology, rather than finding the market and developing products and customers. Investors want founding scientists to 'let go' and defer decisions related to development of the technology to commercially-oriented decision makers. Most venture investors would prefer that founding scientists remain in their academic positions and help the company as members of scientific advisory boards, rather than in R&D operations or other managerial or fiduciary roles.

For many academic start-ups, too often, the question is what to do with a potentially great project without an investable CEO? As stated earlier, business development licensing executives seeking financing for a start-up without an investable CEO are advised to acknowledge the shortcoming and express interest in recruiting management from the investor's network.

Identifying and recruiting investable management, even for the most worthy projects, is a daunting, perhaps the greatest, challenge confronting TLOs. Industry business development executives may have some advantages in this regard; however, entrepreneurial experience and mentality may not be the characteristics of big company managers.

A number of institutions have experimented with a variety of mentor, entrepreneur-in-residence, and related programs. These programs vary in nature and include both formal and informal activities. For example, the University of Michigan TLO, uses mentors-in-residence, a internally-managed gap fund, a catalyst talent network, and a variety of events to identify and recruit CEOs.

- Mentors-in-Residence program embeds seasoned entrepreneurs in 3-8 start-up projects, guiding them from initial evaluation through business modeling, launch and support. They can bridge as interim management, but more often use their networks to help find fundable management. See http://www.techtransfer.umich.edu/resources/venturecen ter/mentors.php.

- Gap Fund Program uses internal funds, matched by a generous state program, to fund commercial readiness activities to address and resolve known risks and engage by contract potential CEOs in transition. See http://www.techtransfer.umich.edu/resources/venturecenter/gapfunding.php.

- Catalyst Talent Network is a database of talent, (experts, volunteers, consultants, potential CEOs managed by a Talent Manager staff member to match needs. See http://www.techtransfer.umich.edu/resources/venturecenter/catalyst.php.

- Events are used to attract, engage and motivate talent to work with projects and start-ups, leading the execution of certain strategic events and partnering with others. See http://www.techtransfer.umich.edu/resources/venturecenter/net working_events.php.9

Secret Sauce, Market Opportunity, and Product Differentiation

In many technology sectors, an investable start-up consists of a proprietary, disruptive, paradigm shifting, breakthrough technology platform. The science is protected by patents which are expected to provide both freedom to operate and the ability to exclude others. The platform technology is exemplified in a differentiated (better) lead product that resolves an unmet need in a compelling market opportunity. The platform aspect of the technology is important in that it provides for additional product opportunities given the high failure rate and attrition in R&D projects. Platform technologies provide a degree of investment security, especially in capital intensive R&D sectors. Platform technologies also permit companies to enter into multiple strategic collaboration and business relationships which provide sources for non-dilutive R&D funding.

Ideally, the breakthrough technology platform and lead product have been published (after patent filing) in a leading journal authored by a key opinion leader. "The peer review process of a highly selective and competitive journal validates that the idea may be a significant breakthrough."10 Data supporting the patent application optimally demonstrates proof-of-principle, technical merit, and commercial potential. In addition, other key opinion leaders have endorsed the scientific foundation of the venture and have published data replicating and confirming the original observation.

In presenting the investment opportunity to potential investors, business development executives and entrepreneurs are advised to describe the company and investment opportunity in a non-confidential 2-3 page narrative (executive summary) or a concise slide presentation. The description should include the scientific foundation and data indicating proofof- principle, technical merit, and potential commercial relevance. Investors recognize that academic discoveries and investment opportunities will have a paucity of data validating the scientific foundation of the discovery and venture.

Business development executives are advised to establish and maintain relationships with investors with aligned strategic interests. Venture capital is a relationship-based industry. Getting an audience with a VC is much easier if there is an established relationship. VCs have historically kept abreast of scientific advancements through journals and conferences and welcome opportunities to interact with key opinion leaders in areas of interest. With the recent contraction of the VC industry, however, funds have fewer resources devoted to sourcing, thus making outreach and relationship building activities even more important.

O.K.! Your Start-up has a Meeting Scheduled With a VC; Now What? What Can You do to Help?

Congratulations! If your start-up has been invited to meet with a potential institutional investor, the venture has already cleared a huge hurdle. Upon initial review or referral, your start-up has been seen as sufficiently interesting to warrant investors' time and consideration.11 Different investors approach initial meetings differently, and entrepreneurs and business development licensing executives making pitches should inquire as to how investors prefer to approach these initial meetings. Some investors may want to be 'pitched,' that is, for someone to make a (brief) presentation about the essential elements of the business—management, secret sauce, market opportunity, and product differentiation. However, many VCs will not want to be pitched, listen to a presentation, or even review a slide deck. It is more likely than not that an experienced investor will have prepared for the meeting having thoroughly studied the slide deck and related material, and perhaps even having done preliminary due diligence on the opportunity. Presenters should be prepared to engage in a discussion of their vision and how they intend to develop the technology and the company and their understanding of the market and customers' needs.

TLOs are increasingly launching programs to assist budding academic entrepreneurs to obtain non-dilutive capital in the form of grants to de-risk investment opportunities, e.g., SBIR grants. Funds from such programs can be used successfully if capital is used to conduct the "right" experiments and gather data indicating the technical merit and commercial potential and relevance of the scientific hypothesis. However, without industry experienced guidance, academics rarely possess the commercial expertise and resources necessary to identify and conduct the needed gating, de-risking experiments. Business development executives are advised to obtain industry guidance in the identification, selection, design, conduct, and reporting of de-risking experiments.

Finally, business development executives are advised to communicate effectively and in a timely manner with investors expressing interest in an opportunity. While VCs may take months, or even years, to reach a positive investment decision; once they do, they want to act quickly to conclude agreements in a timely and frictionless manner. VCs have little patience for what they view as unnecessary delays, untimely communication, and non-standard license terms.

VC Financing Jargon, Term Sheet, and Documents

As stated previously, the purpose of this article is to demystify venture capital financing jargon, term sheets, and documents. Venture Capital financing jargon is not in the common lexicon of business development and licensing executives.12 VC term sheets and documents focus on an equity financing round with a company and do not resemble license term sheets and agreements.13

The VC financing term sheet is the basis for and summary of the material economic terms, that is the terms that matter, to VCs. Typically, a lead investor proposes a financing term sheet to a company upon completion of its due diligence and decision to make an investment. A summary of the material terms of the proposed financing, term sheet, is typically presented in a form of letter or other agreement signed by the lead investor(s). The term sheet, more often than not, includes a summary of the transaction, investors' rights, and other provisions. The proposed financing term sheet will eventually be documented in a series of comprehensive related agreements, which generally include:

- Certificate (Articles) of Incorporation of the company, also often referred as the company's charter ("Charter");

- Stock Purchase Agreement ("SPA");

- Investor (Shareholder) Rights Agreement ("IRA");

- Right of First Refusal/Co-Sale Agreement; and

- Voting Agreement.

Venture capital financing term sheets are generally not binding upon the parties, except for a 'no shop' period of exclusivity and confidentiality provisions, which are binding.

The deal summary (often, the cover sheet of the Term Sheet) identifies the company, the investors and the amounts each is committing, the class of stock to be issued (e.g., Series A Preferred), and the principal terms of the financing. These principal terms generally include amount of the financing (including tranches, where appropriate), price per share, premoney valuation, financing closing schedule, use of proceeds, and equity capitalization (cap table).

The Certificate (Articles) of Incorporation/ Charter is the key document in a VC financing. The Charter defines and references the terms that convey the economics of the transaction. The Charter presents the complex issues in a financing. Charters are neither easily read nor understood, even by experienced investors, entrepreneurs, and their counsel. The key terms in the Charter, as in the financing term sheet, described in greater detail below, include the class of equity being purchased (e.g., participating preferred), dividends, corporate controls, liquidation preference, voting rights, anti-dilution, mandatory conversion, and pay-to-play.

The Stock Purchase Agreement ("SPA") sets forth the basic terms of the purchase and sale of the security (e.g. preferred stock) including the purchase price, closing date, and conditions to closing. Generally, the SPA describes neither the characteristics of the stock being sold (which are defined in the Charter) nor the relationship and agreement among the parties related to the stock after the closing, such as registration rights, rights of first refusal and co-sale, and voting arrangements. Major terms of negotiation in the SPA include:

- The price and number of shares being sold and the use of proceeds;

- Representations and warranties that the Company (and often the Founders) make to the investors and vice versa;

- The company's and investors' obligations (conditions) at closing; and

- Other provisions likely to include requiring the Company to reimburse 'reasonable' expenses of the investors and their counsel related to the financing.

The Investor Rights Agreement ("IRA") typically covers a variety of issues, including:

- Investors' rights related to registration of their shares for public offerings;

- Management and information rights;

- Right to participate pro rata in future stock issuances;

- Matters requiring approval by the Board;

- Non-competition and non-solicitation agreements;

- Board matters;

- Employee stock options;

- Key person insurance; and

- Related covenants and other provisions intended to protect investors' interests.

Right of First Refusal / Co-Sale Agreement, also referred to as "take me along right," enables the company first and investors second a right of first refusal to purchase shares offered for sale by founders and gives the investors the right to sell a portion of their shares as part of any sale of shares by the founders.

Voting Agreement describes the composition of a new Board of Directors upon closing the financing on any voting restrictions on shares.

Negotiating the Financing

VC financing term sheets are investor-centric. That is, the document and its terms represent the needs and wants of investors and deal terms that matter to them. Like good license term sheets, which seek to create a win-win risk-reward balance, venture capital financing term sheets, while expressing the interests of investors, serve as a first offer or floor for negotiations.

As in all negotiations, leverage matters, as do negotiating skills. Negotiating leverage and skills are impacted by the circumstances of the negotiation, situation of the parties, and each party's ability to effectively utilize their knowledge and power. Leverage is key, as is the Golden Rule (he/she with the gold, makes the rules).14

VCs from different regions (e.g., West Coast and East Coast) and technology sectors (e.g., life sciences and technology) differ in needs, wants, and customary practices in financings. However, the jargon, term sheets, and documents are consistent across geographies and technology sectors.

Equity Stakes

Institutional and organizational founders, as licensors, typically take common stock as founders (as opposed to preferred stock which is taken by cash investors). Equity is typically taken in lieu of up front licensing fees. However, the amount of common stock taken varies greatly among different institutions and technology sectors.

Generally, founders take equity at the time of a company's founding, and the amount and value of equity is typically included in the pre-money value of the company. Experience indicates that founders equity pre-money value is typically in the $2M to $7M range. These pre-money values directionally represent fully diluted ownership interest in the range of 2-40 percent. Institutions' founding equity position, as opposed to the inventors' stake, is typically a contentious point of negotiation. Experience indicates that investors perceive the institutions' contribution in historical terms and as relatively little importance. Conversely, investors often view inventors' contribution, retrospectively and prospectively, as more valuable.15

Experience indicates that the variance in pre-money value and founders' equity (institutional and inventors) is multi-factorial based on:

- Technology sector;

- Market opportunity;

- Stage of development of the technology and product;

- Perceived value of pre-license value creation (sweat equity);

- Scientific founders' experience and track record in commercialization, generally, and start-ups, specifically;

- Institution's experience, ability, and track record (reputation) in launching start-ups that create value for investors;

- Potential exit value and risk; and

- Nature and scope of licensed patent rights.

Understanding these value drivers and VC financing mentality, jargon, term sheets, and documents is critical for those seeking to be taken seriously by VCs and to realize value from their successful start-ups. However, and especially for start-ups in capital-intensive sectors (e.g., therapeutics, devices, diagnostics, clean tech, etc.), equity dilution is significant resulting in a financially immaterial percentage of ownership.16

Increasingly, institutions are including in their license and stock purchase agreements the right for them and their assignees to invest in future financing rounds. This right is called a Participation Right or Pre-emptive Right. Typically, other investors enjoy this right to participate in future financing rounds and thereby avoid unwanted dilution.

Equity dilution, especially in capital intensive ventures, substantially reduces the opportunity for material financial gain from equity at exit. A Participation Rights enables the institution, and/or an affiliated fund, to invest dollars alongside other investors in future rounds. Business development executives are encouraged to insert Participation Rights language in their license agreements to preserve the right.

Participation Rights Language

If the Company proposes to sell any equity securities or securities that are convertible into equity securities of the Company, then the University and/or its Assignee (as defined below) will have the right to purchase up to 10 percent of the securities issued in each offering on the same terms and conditions as are offered to the other purchasers in each such financing. Company shall provide thirty days advanced written notice of each such financing, including reasonable detail regarding the terms and purchasers in the financing. The term "Assignee" means (a) any entity to which the University's participation rights under this section have been assigned either by the University or another entity, or (b) any entity that is controlled by the University. This paragraph shall survive the termination of this agreement.

Key Terms in Venture Capital Financing Documents17

Charter

The Charter is a document publicly filed with the Secretary of State of the state in which the company is incorporated. The Charter establishes the rights, preferences, privileges, and restrictions of the security (stock) itself.18 The Charter is the only meaningful document that is publicly filed. Delaware is considered a company-friendly state and, thus, Delaware is often the preferred governing forum for companies seeking or likely to seek institutional financing. As stated earlier, the Charter contains the deals terms that affect the economics of the transaction to the investors.

Liquid Preference/Participating Preferred

First and foremost among the terms in the Charter is the nature and class of the security (stock) itself, e.g., preferred, and whether and to the extent the class of stock has a liquidation preference or participates, e.g., participating preferred with the common equity holders. Liquidation preference refers to the multiple on its initial investment that investors are entitled to receive from capital paid by an acquirer prior to conversion of the investors' preferred stock to common stock. In effect, this is a bonus payment to investors, presumably for the risk. Investors use liquidating preference / participation to adjust the economics of the financing, that is their return potential and risk, based on pre-money valuation. Participating preferred is more commonly found in life science transactions than those in the technology sector.

- A full participating preferred entitles the investor to receive a multiple of its investment as a payment prior to conversion to common.

- A partial participating preferred entitles the investor to receive that portion (e.g., half) its investment prior to conversion to common.

- A liquidation preference may also be capped its total dollar return to investors.

Investors refer to calculations computing the effect of the liquidation preference as the "waterfall." The waterfall is a financial model to express the potential returns to the investor based upon the eventual exit value of the company. The waterfall calculates returns for investors of different classes of stock based on their rights and preferences.

Dividend

The dividend specifies the minimum return on investment as a percentage of capital invested. An 8 percent return is typical currently. Dividends may be accrued and cumulative. Unpaid dividends may be paid upon conversion of the preferred stock to common stock prior to a liquidation event. Typically, dividends are not paid if the preferred is converted. Alternatively, the company may have the option to pay accrued and unpaid dividends in cash or in common shares valued at fair market value, which is referred to as payment-in-kind ("PIK") dividends.

In effect, dividends are a financial 'kicker' to investors above and beyond equity appreciation. For example, a $10 million preferred stock investment is entitled to receive upon a liquidation event (exit, acquisition) a dividend (or coupon) equal to 8 percent on $10 M accrued and compounded daily from the date of investment until liquidation.

Voting Rights

Typically, preferred stockholders are entitled to vote their shares together with common shareholders as a single voting class. The Charter may also contain veto rights in favor of the investors. The Charter sets out the number of authorized shares and the number of members of the Board (Directors) preferred shareholders are entitled to elect.

Anti-Dilution Provisions

Preferred investors often seek protection in the event that the company issues additional securities at a purchase price less than the conversion price on the shares purchased by the preferred investors. Anti-dilution provisions detail the adjustment to the conversion price to protect the existing preferred shareholders from dilution. Two conversion methods are typical—weighted average and full-ratchet. The weighted average method considers the number of new shares to be issued relative to the number of shares already outstanding. The full-ratchet method is less frequently used and reduces the conversion price of the previously purchased preferred shares to the price at which the new shares will be issued.

Mandatory Conversion

Preferred shares are automatically converted to common stock upon an underwritten initial public offering ("IPO") of an acceptable size. Investment bankers generally require this mandatory conversion. Exceptions to mandatory conversion are used to preclude a single investor from controlling the timing of the conversion.

Pay-to-Play

This recently adopted provision is becoming more typical. In effect, pay-to-play penalizes existing investors for declining to participate, on a pro-rata basis, in future/follow-on rounds of financing. This provision is desired by new investors who want existing investors to support a new round. This provision is increasingly common in bridge rounds and deals in which there are angel investors. (It has been suggested that the provision disproportionately penalizes angels, which may be the intent of VCs.) This provision seems to be invoked more commonly in situations in which the company is not performing up to expectations and the company refuses to adjust the pre-money value of a financing round accordingly. However, the provision penalizes existing investors, rather than management, for non-performance. In effect, the pay-to-play requirement may cause excessive funding in poorly performing companies.

Stock Purchase Agreement

Typical VC financing term sheets include a small number of terms which are detailed in the SPA, including: representations and warranties, conditions to closing, and expense reimbursement.

Representations and Warranties

The Company will be asked to make what investors consider "standard" representations and warranties regarding the state of the company. Investors are also likely to ask the founders to make representations and warranties about the ownership of intellectual property and any related license agreements, especially if the company is an academic start-up.

Conditions to Closing

Standard conditions to closing include satisfactory completion of due diligence (legal, financial, intellectual property, etc.), qualification of shares under applicable Blue Sky laws25, filing of the Charter, and a clean opinion from the company's counsel regarding the financing.

Expense Reimbursement

Open to negotiation (and leverage considerations) is the company's obligation to pay or reimburse investors' legal and administrative costs related to the financing. Customarily, this obligation is voided if the investor(s) do not complete the financing without cause.

The Investor Rights Agreement

Registration Rights

Registration rights are important to investors, as well as to founders and management. These rights describe conditions enabling them to register their shares for sale to the public. These rights are increasingly customary and standard, and in essence, provide that upon conversion of the shares to common, the shares become "registrable securities" and thereby tradable under Securities Act Rule 144.20

Investors also generally demand registration rights requiring the company to register for sale preferred investors' shares after an agreed upon number of years (e.g., three to five) following the company's initial public offering ("IPO").

Lock Up

Lock up is an agreement that existing investors will not sell or otherwise transfer their shares for a limited period of time, e.g. 180 days, typical in connection with an IPO. Locking up existing stockholders for a period of time is a customary request/demand by investment bankers underwriting an IPO. The lock up typically restricts company "insiders," that is, officers, directors, founders, and preferred shareholders, from selling their shares during the agreed upon period. Even if such restriction in not in the financing documents, it is more likely than not that investment banker(s) underwriting the IPO will require a lock up. However, the institution's founding stockholding share may be so small at the time of the IPO that it is not required to sign the lock up, and in that case, may be advised not sign and thereby preserve its option to sell soon after the IPO.

Management Rights Letter

VCs often require a management rights letter. In the letter will be authorization for certain investors to attend Board meetings, as observers if they are not members of the Board, advise and consult with management of the company, and inspect the company's books and records. VCs require these rights in order to obtain an exemption from regulations under the Employee Retirement Income Security Act (ERISA) of 1974.21 Prior to closing the financing, investors are likely to also require reasonable access to the company's facilities and personnel for due diligence.22 In the Management Rights Letter, the company agrees to provide investors with annual, quarterly, and occasionally monthly financial statements and other information provided to the Board of Directors. In addition, the company agrees to provide investors annually with a comprehensive operating budget and capitalization table.

Right to Participate Pro Rata in Future Financing Rounds

It is customary and standard for investors to be granted the right to participate, pro rata their percentage equity ownership, in subsequent issuances of equity (future financing rounds), not including certain exempted issuances (e.g., issuances of stock options for employees). In the event that an investor elects not to purchase its full pro rata share in a future financing round, other investors have the right to purchase the remaining pro rata shares.

Right of First Refusal/Co-Sale Agreement

This agreement grants to the company first and the investors second the right of first refusal to purchase shares offered for sale by founders and gives the investors the right to sell a portion of their shares as part of any sale of shares by the founders.

Voting Agreement

Board of Directors

A new Board is trypically put in place at the closing of a financing round. Investors are likely to want a majority of the Board to include representatives of the investors, the CEO, and perhaps another independent person or two who are not employed by the company and who are mutually acceptable to founders, management, and the new investors.

Drag-Along Right

The drag-along right requires shareholders to vote their shares in favor of a sale of the company, which is approved by the Board and holders of an agreed on percentage of outstanding shares.

Other Matters

No Shop / Confidentiality

The no shop / confidentiality provision requires the company to work in good faith to close the financing and restricts the company and its founders for an agreed upon period of time (e.g., weeks) from soliciting, initiating, encouraging, or assisting any competing financing proposal. This provision further requires the company not to disclose terms of the term sheet.

Conclusion

For those unfamiliar with venture capital, this article has sought to demystify their financing mentality, jargon, and documents. Given the increasing number of deprioritized R&D assets and projects being spun-out of from large and small biopharmaceutical companies into new ventures, industry licensing executives need to become familiar with the attitudes, language, and deal structures of VCs. Likewise, academe is more likely than not to continue to seek to commercialize their most interesting new discoveries via start-up ventures. Understanding deal terms that matter to institutional investors is important for both academic technology transfer managers and industry licensing executives.

Appendix A: License Term Sheets

Customary and standard licensing jargon and term sheets used by not-for-profit (academic) research institutions23 generally focus on:

- The IP to be licensed, including the extent to which the rights are being granted extend to corresponding foreign counterparts and other extensions (e.g. continuation, continuation- in-part, divisional, and re-issue patents and patent applications);

- Scope of rights being granted (e.g. exclusive worldwide license, field of use, right to sublicense, to make, have made, use, import, sell, and offer for sale licensed products);

- Financial considerations:

- Up-front payment in cash and/or equity;

- License maintenance fees;

- Royalties—running and minimum;

- Sublicense fees and sublicense revenue sharing obligations;

- Milestone payments; and

- Sponsored research funding;24

- Risk management provisions:

- Warranties;

- Indemnification;

- Representations; and

- Insurance obligations;

- Reporting, audit, and information rights:

- Progress reports (including an example of an acceptable report);

- Audit rights and sales records; and

- Royalty reports (including an example of an acceptable report);

- Equity considerations (in licenses to start-ups with equity):

- License initiation equity;

- Representations and warranties;

- Voting and dividends;

- Covenants;

- Piggyback and S-3 registration rights;

- Redemption rights;

- Participation (preemptive) rights;

- Right of first refusal;

- Co-sale right;

- Drag-along right;

- Certification/Articles of Incorporation;

- Other provisions:

- Confidentiality;

- Reservation of rights;

- Due diligence obligations;

- Use of name restrictions;

- License completion timetable; and

- Binding/non-binding nature of the Term Sheet.25

- Vannevar Bush, Science, the Endless Horizon, 1945.

- FY2011 AUTM U.S. Licensing Activity Survey, Table 12: Startups Formed and Primary Place of Business, 2007-2011.

- Ibid.

- New York Academy of Sciences, "Predicting Spinoff Success," http://www.nyas.org/Publications/Detail.aspx?cid=d534df1d-ae31-4bb9-bf27-e51c5c1c4720.

- While industry experienced management is essential for later stage companies seeking financing, discovery stage ventures may be fundable without an investable CEO. VCs, especially those willing to do "complete assembly" start-ups are more likely than not to have relationships with executives who may be "in residence" or otherwise affiliated and are able to serve as interim CEOs. This level of management leadership may be all that is required for early stage technologies funded to establish proof-of- principle and confi m the founding scientifi hypothesis of the venture. Institutions and companies seeking funding are advised to position and title management personnel without requisite CEO level capability as "interim," "general manager," or other designation signaling temporary status.

- In 2013, for example, as a group, VCs are more interested in early stage information technology ("IT") given the capital efficiency and potentially significant valuation step up from seed to Series A. In particular, there are also strong tailwinds (positive investment climate) in 2013 for healthcare IT opportunities. While there appears to be much 'talk' about interest in ag-bio, few venture investments are being made in this sector. Conversely, strong investment headwinds are being felt in capital intensive sectors including clean energy and electronics. Therapeutics, the mainstay of academic discoveries and bio- pharmaceutical company spin-outs, continue to generate interest, despite their capital intensity, especially in oncology and orphan indications.

- Market knowledge and understanding is also what investors want to see and hear from TMs pitching technology transfer deals. In fact, investors often say that this lack of real world relevant industry experience is what they would most want to change in both TLOs and TMs.

- Conversely, investable CEOs do not try to sell a 'field of dreams;' that is, if the company builds it, customers will surely come.

- Thank you to Ken Nisbet, Executive Director of the University of Michigan TLO, for his assistance in crafting this section regarding identifying and recruiting investment CEOs.

- Robert Langer, Nature Biotechnology 31, 487-489 (2013).

- Experience indicates that other than meetings taken as a courtesy, VCs meet with only about 10 percent of pitched deals.

- For a more extensive discussion of term sheets, see Berneman, L.P., Denis, K.A. and Wright, C.F. "Using Term Sheets to Get What You Need and Negotiate for What You Want in Industry-University Licenses," in Association of University Technology Managers Technology Transfer Practice Manual, Marjorie Forster, editor. 2003.

- See Exhibits A and B to compare and contrast a model license term sheet and VC financing term sheet. [ADD: cross reference to NVCA forms on web].

- Golden Rule, of course, also is true for future financings. Anytime a new investor with leverage, enters the picture everything agreed to by previous investors and the company is subject to re-negotiation and change.

- Equity models other than up front exit, including milestone and phantom equity. Though no longer common, historically some institutions deferred taking up front equity positions in favor of being granted equity positions based on the achievement of pre-determined corporate and product development milestones or benchmarks. The equity given at the milestone is based upon the fully diluted share count at the time of the milestone achievement. For example, a university might receive 0.375 percent equity in the company at the time of IND filing and an additional 0.75 percent upon finishing Phase 2 studies. Among the challenges with the milestone equity model for universities is that they only receive equity at predetermined milestone events, which may not be achieved prior to an exit.

More common than milestone equity structures, but now also generally out of favor except in "express licenses" and the like, is phantom equity. Clearly, phantom equity is gaining in popularity as express license structures are used. Phantom equity is an arrangement in which the institutional founder does not hold equity in a start-up until the time of the company's sale (exit). In this equity structure, the founder is given an amount of cash equal to a pre-determined percentage of the market value of the enterprise at the time of sale. For example, as part of their "Carolina Express License," the University of North Carolina takes 0.75 percent of the start-up's fair market value at the time of a liquidation event (M&A, IPO, asset sale). The NIH is currently using a similar structure and UCSF used a similar structure in the past. Typical phantom equity is in the range from 0.5-2 percent market capitalization (value) at exit. - A study by Berneman et. al. at U Penn in 1999 found that across multiple institutions and technology sectors, the average equity percentage holding for institutions at the time of exit was 0.6 percent.

- Readers may wish to view model financing documents from the National Venture Capital Association. See http://www.nvca.org/index.php?option=com_content&view=article&id=108&Itemid=136.

- Model NVCA Term Sheet, March 2011.

- State laws regulating the offering and sale of securities to protect the public from fraud.

- Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time, after the restrictive legend on the back of the security has been removed by a transfer agent. http://www.sec. gov/answers/rule144.htm.

- Absent an exemption, if a pension plan subject to ERISA is a limited partner in a venture fund, then all of the venture fund's assets are subject to regulations that require the venture fund assets to be held in trust, prohibit certain transactions, and place fiduciary duties on fund managers. However, a Venture Capital Operating Company ("VCOC") is not deemed to hold ERISA plan assets. To qualify as a VCOC, a venture fund must have at least 50 percent of its assets invested in venture capital investments. In order to qualify as a venture capital investment, the venture fund must receive certain management rights that give the fund the right to participate substantially in, or substantially influence the conduct of, the management of the portfolio company. In addition to obtaining management rights, the fund is also required to actually exercise its management rights with respect to one or more of its portfolio companies every year. http://www.startupcompanylawyer.com/2007/12/03/what-is-a-management-rights-letter/.

- Investors who are competitors or who have competitive interests may not be afforded such rights to information.

- See Appendix A for a model academic licensing term sheet.

- A number of institutions are increasingly using licenses to start-ups to generate near-term sponsored research support for investigators and value such funding as a productivity metric.

- For a more extensive discussion of term sheets, see Berneman, L.P., Denis, K.A. and Wright, C.F. "Using Term Sheets to Get What You Need and Negotiate for What You Want in Industry-University Licenses," in Association of University Technology Managers Technology Transfer Practice Manual, Marjorie Forster, editor, 2003 and later editions.