les Nouvelles November 2016 Article of the Month

Exploring The New Dimension Of China’s Invention Economy

Attorney

Lung Tin Intellectual Property Agent Ltd.

Beijing, China

Attorney at law,

Teacher of Innovation Economics

Sciences Po Paris

Paris, France

While acknowledgement of intellectual property rights in China can be traced back as far as the Tang Dynasty (618-907 AD), the first patent- specific law in China was enacted in 1889, towards the end of the Qing Dynasty. Modern Chinese patent law, however, began with the issuance of the Provisional Regulations on the Protection of Invention Rights and Patent Rights in 1950, which provided rewards to inventors but left ownership of intellectual property in the hands of the State. The onset of the Cultural Revolution in the mid-1960s, however, brought an end to even this modest recognition of intellectual property.

China began to revisit intellectual property in the early 1980s, first sending a number of researchers to study patent law and practices in other countries and then in 1984 promulgating the Patent Law of the People’s Republic of China (the “Patent Law”). China subsequently became a member of the Paris Convention for the Protection of Industrial Property (the “Paris Convention”) in 1985. The Patent Law was amended in 1992 and China became a signatory to the Patent Cooperation Treaty (PCT) as of 1994. The Patent Law was amended most recently in 2001 in an effort to bring it in line with the relevant provisions of the WTO Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).1

Innovation and economy have been the focus of Chinese Government development policy for many years (National People’s Congress—NPC—and the Chinese People’s Political Consultative Conference—CPPCC). In early 2006, China convened a National Science & Technology Summit that issued the outline of “The National Medium-and Long-Term Science Plan 2006– 2020.” NPC and CPPCC have then made the innovation as one of the five key concepts of development for the 2016-2020 fifth-year period.

All along these years China has experienced substantial changes in virtually every aspect of its society and economy. As underlined by Professor Xiaolan Fu in her last study:2 “The National Innovation System (NIS) has experimented a series of reform initiatives driving it from a plan-based system towards a market-based open system of innovation.” Now the main challenge is to “move from imitation to innovation” and to transforming the economy from a manufacturing-based to a knowledge-based economy and to perform the transition from “Made in China” to “Invented in China.”3

First World Inventive Economy— the Challenge of Quality

• China Handled More Patent Applications for Inventions than any Other Country:4

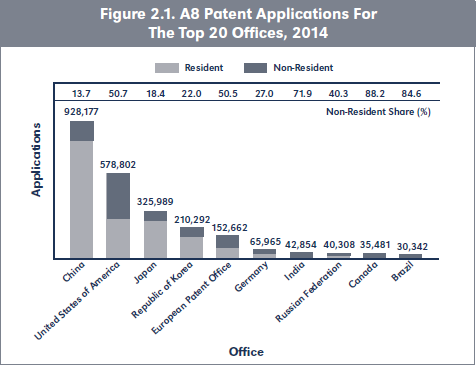

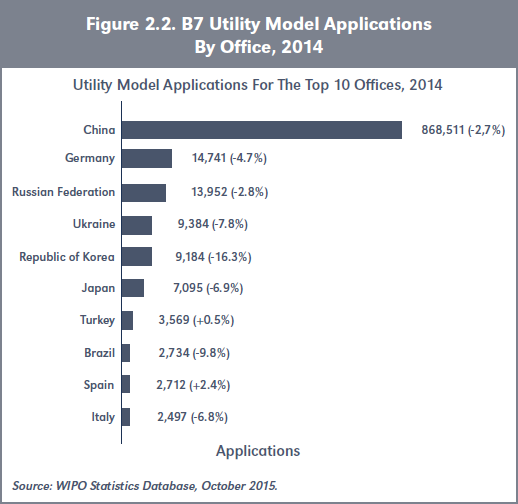

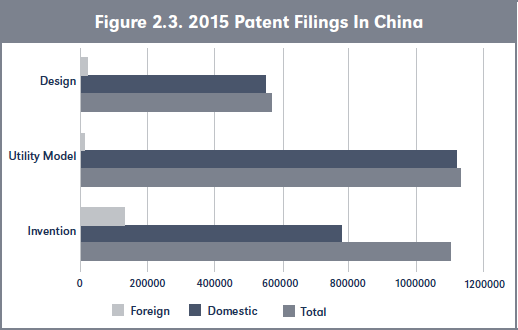

In 2015, the total number of patent and utility models filings reached 2,798,500, among which patent applications for inventions surpassed one million (see Figure 1, 2.1 and 2.2; all figures start on page 147), that is to say more applications than Japan and the U.S. combined.

According to the data released at a press conference from the State Intellectual Property Office (SIPO) of China on January 14, 2016, 1.102 million patent applications for inventions were received in China in 2015, up 18.7 percent from last year, “being the top patent application filer of the world for five years.”

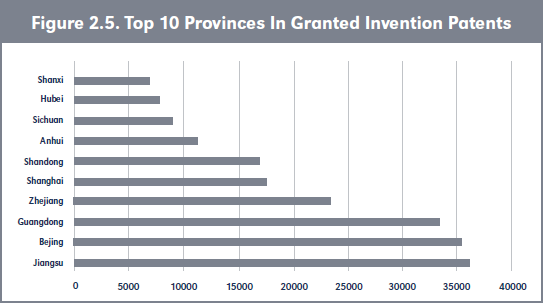

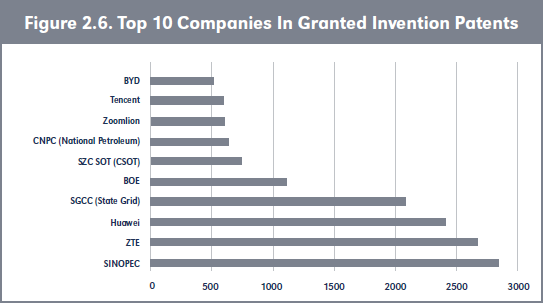

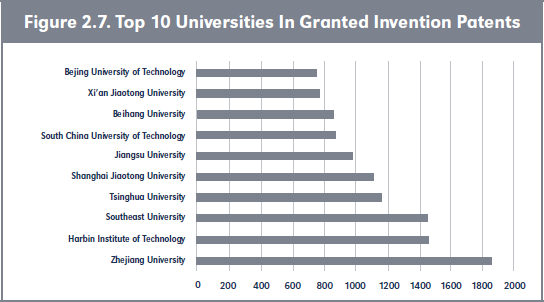

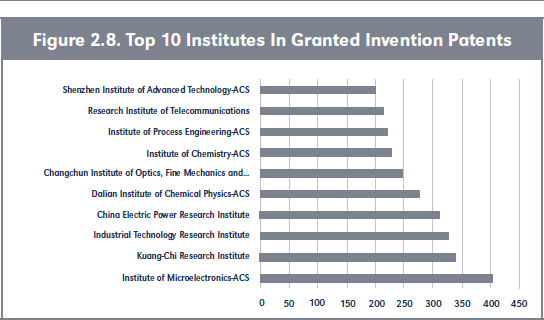

This flow is quite concentrated in three provinces: Jiangsu (36,015), Beijing (35,308) and Guangdong (33,477). (Figure 2.4) China’s top oil-refiner SINOPEC obtained 2,844 invention patents, followed by telecom giants ZTE (2,673) and Huawei (2,413). (Figure 2.5) Chinese Universities are also very active, with the top three being Zhejiang University (1,865), Harbin Institute of Technology (1,454) and Southeast University (1,453). (Figures 2.7 and 2.8).

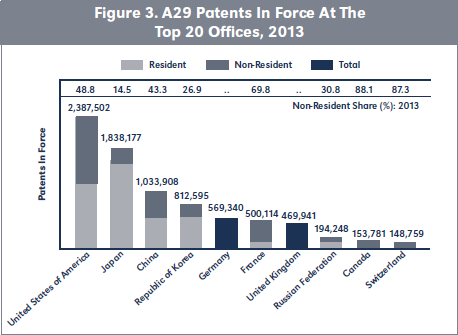

In 2015 about 359,000 invention patents were granted, 263,000 of which were granted to domestic applicants, 100,000 more than in 2014, up 61.9 percent from last year (see Figure 2.3), which placed China in terms of stock of granted patents at the third place behind USA and Japan, with more than 1 million patents in force (see Figure 3).

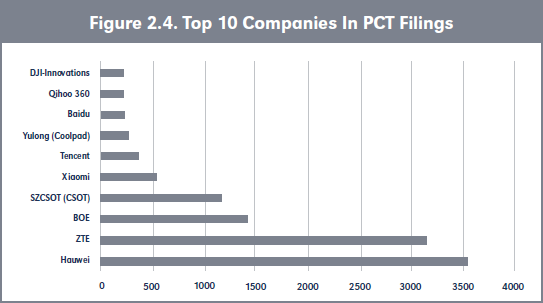

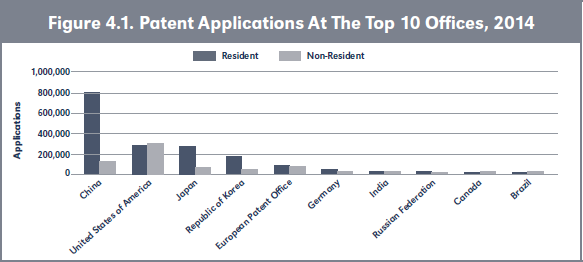

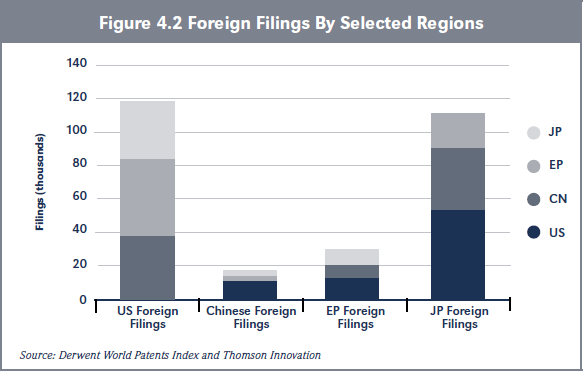

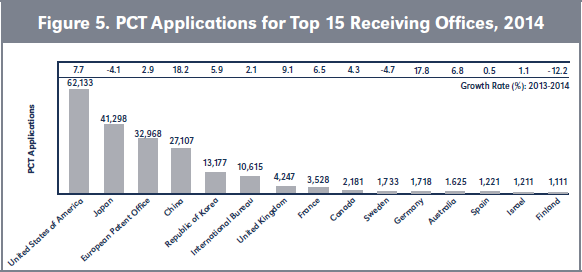

What is very specific of Chinese patent landscape is the small proportion of foreign filings compared to domestic ones, as well as the small proportion of international filing by Chinese organizations as illustrated by the relative small number of PCT filings: 27 000 in 2014 compared to 62 000 for the U.S.A. (Figures 4.1 and 4.2) In 2015, SIPO received 30,548 PCT applications, up 16.7 percent year on year, 28,399 of them were from domestic applicants, up 18.3 percent year on year; 2,149 were international (see Figure 5). China’s top telecommunication giants Huawei and ZTE were the top two filers with 3,538 and 3,150 PCT filed respectively.

• More to Come

If this trend extends over the next coming year (official objective is to reach 14 patents per 10,000 residents by 2020—to compare, California, U.S. State with the highest per capita patent rate, comes closest at 11.4 patents per 10,000 residents), we may expect that China will file in the near future around two million patents a year. As for PCT applications, if China reaches in the future the average relative number of PCT patents than the average OECD countries, it should file more than 100 000 PCT Patents per year.

• The Quality Challenge

This all-time patent growth record raises the question of the quality of the patent granted—at a time where the flow of patent invalidation of patent has increased since several months in the USA.

On one hand the public policies in favor of patenting have been very pro-active and the volume of patent has been a way to evaluate the innovative performance of the regions. Thus a number of incentives at the territory level or at the industry level have been put in place.

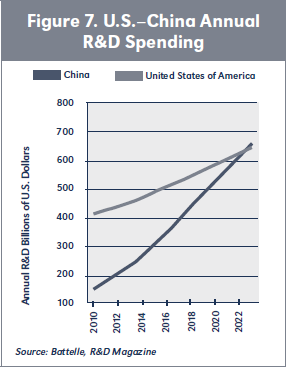

On the other hand, the investment in R&D has been reinforced tremendously. In 2011, China surpassed Japan’s overall spending. By 2018, it is expected to surpass the combined R&D spending of Europe’s 34 countries. And by sometime around 2022, it will likely also exceed the R&D investments of the U.S. in absolute terms (Figure 7).

One of the most salient features of this widespread patent culture is the widespread teaching of intellectual property—even at school, (see Figure 6)—which doesn’t exist in any other country, where IP is taught only to few students at the end of their Masters in law.

This policy of supply and demand has undoubtedly been the source of the surge in patent and utility models over the past years, and it has made patenting a common tool of economy and business—which is not yet the case in developed and in developing countries.

In this context the question of quality of Chinese patent has been contested. The evidence that can be collected on this topic is, unfortunately, very limited, but we would add to the debate the following two remarks:

- What can be observed is the real strengthening of the human resources of the Chinese Patent Office (SIPO) which has hired in the last years a large number of examiners. One of the most visible results is the large reduction of examination delay— which became one of the shortest in the world (see Figure 9).

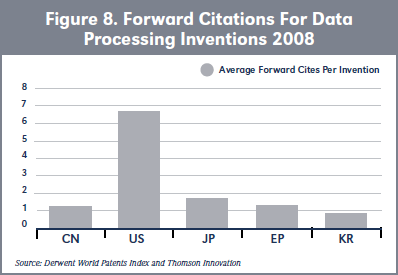

- On the scientific side, it is widely accepted that the more often an invention is cited by later published inventions, the more valuable that invention is perceived to be by others. One study made by Thomson Reuter on China IQ5 on the data processing domain shows that, although far behind the United States for the same metric (6.72 average forward cites per invention), the citation rate of China (1.17) compares favorably with Japan (1.82 average forward cites), Europe (1.31 average forward cites) and exceeds the South Korean rate (0.76 average forward cites).

• A Stronger Enforcement

Many reforms have intended in the last years to increase patent enforcement: besides the creation of IP specialized courts (Beijing, Shanghai, Guangzhou), the new 4th amendment of the Patent Law introduces more precise qualifications for infringement (willful, mass, and repeated), recourse to true technical experts, increase in punitive damages, extension of administrative injunction possibilities, widening of the burden of proof, etc.

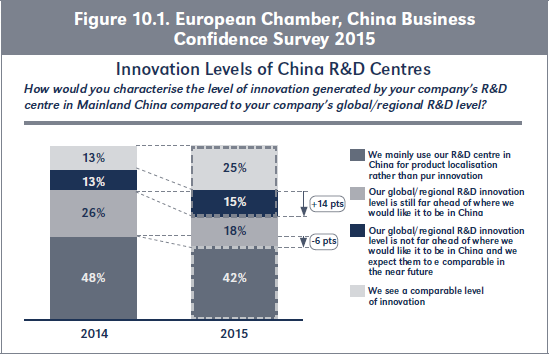

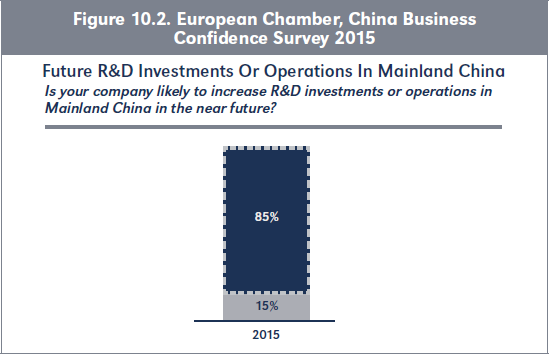

Thus the reliability of the Chinese system is changing: the 2015 China Business Climate Survey conducted by the American Chamber of Commerce in China,6 shows that 86 percent of respondents said that China’s enforcement of intellectual property regulations had improved in the past five years (Figures 10.1 and 10.2), and the European Chamber of Commerce in China stated that 56 percent of its respondents say that enforcement is inadequate but against 95 percent some years ago.7

From Imitation to Invention

• China Vows to Speed Up Building an Innovative Economy and an IP Power:

The State Council of China issued an opinion at the end of December 2015,8 which vows to implement national IP strategy, deepen reform in IP key areas, carry out more strong IP protection, promote the development in new technology, new industry and new commercial formats, enhance industrial internationalization development level, and safeguard and encourage mass entrepreneurship and innovation.

China enacted an amendment Law on Promoting the Transformation of Scientific and Technology Achievements (2015 Amendment) at the 16th Session of the Standing Committee of the 12th National People’s Congress on August 29, 2015, which enhanced in its article 1 the transformation of scientific and technological achievements into real productive forces—by motivating inventors and IP creators in institutes or universities to operate transfer, license and by encouraging enterprises in implementing partnership, together with research institutes or universities.

More, the amendment improves the supports for transformation of scientific and technological achievements, such as establishing technology markets, cultivating and developing intermediary service agencies, providing trading places and disseminating technology trading information.

China Pioneer in Technology and IP Exchanges and Marketplaces

The role of technology and invention transfer in the development of Chinese economy is crucial. From the point of view of western industrial companies this transfer has been considered during the first period as a counterpart to enter the Chinese market. Since some years, this is no more the case as the scientific basis of the country have been soundly strengthened (for example there are now more researchers in China than in the European Union).

As China becomes more and more an innovative economy, “open innovation” concerns more and more industries and universities. The number and impact of different forms of collaboration and exchange are in fact multiplying. While taking its place among global R&D leaders, China recognizes the leverage available through international collaboration. Many of China’s R&D programs involve collaborations with European and/or U.S. research organizations. According to the Battelle/R&D Magazine Global Researcher Survey, about a third of China’s advanced R&D is pursued in collaboration with U.S. research organizations, and about a quarter in collaboration with European research organizations.9

In this Context, the Attempts to Create Real Market Mechanisms in the Field of Patent and Technology Exchanges Multiply.

China set up its first technology stock exchange market in Shanghai in 1999. Since then, large-scale technology equity platforms have emerged in Beijing, Chengdu, Shenzhen, Wuhan, Tianjin and Shenyang and accelerated the outbound trade of technological innovation, as well as corporate venturing in commercialising internal new technology, products and large numbers of patents. However, the role that the technology transaction market has played in China’s regional innovation system was not significant over the 1998–2004 period.10

As the improvement of protection of intellectual property rights progress, these exchange and market initiatives ramp up again.

This evolution follows the reflection of OECD when it says, “Facilitating the mobilisation, sharing, or exchange of patents is increasingly important to promote innovation in this globalised and well-networked world, where the circulation of ideas and technologies is essential to innovation. In the context of open innovation, patents are expected to play a role as a means for transferring ideas and technologies from one entity to another”(Guellec, Yanagishawa, OCDE, 2009).

• Chinese Government has Promoted IP Marketplaces for Transformation of Innovations

At the beginning of 2016, the biggest fund of its kind nationwide—a government-led intellectual property fund “Beijing key industry intellectual property fund”—with a total planned capital of 1 billion RMB ($153.3 million) was launched.11 The fund becomes the fourth sovereign fund after IP Bridge (Japan), Intellectual Discovery (South Korea), and France Brevets (France)- but the goals of all these funds are different.

The first phase of 400-million-yuan capital has been sold out focusing on investment in startups and growing companies with high-value patents in mobile internet and biomedicines. The first phase was from the government (RMB 95 million) and investments from industries, IP service agencies, and investment agencies (RMB 305 million). The fund will cooperate with major national IP projects and help IP agencies build multilevel cooperation with investment and financing institutes.

This initiative takes place within the networks of IP marketplaces financially supported by the government. These networks are composed likewise:

- At the State Level

- NAST (National Achievements of Science and Technology; www.nast.org.cn): under the Ministry of Science and Technology (MOST), Office of Technology Achievements. With some technology information, NAST focuses on the supporting and establishing service demonstration bases (14 bases now including Beijing), building up and maintaining national databases, and supporting and supervising local bureaus and technology transfer centers.

- CTEX (China Technology Exchange; www.ctex.cn): was set up by MOST, the State Intellectual Property Office, the Chinese Academy of Sciences, and Beijing Municipality. Supported by three platforms, i.e., on-line technology trading platform (www.ctexmll.com, claimed to be the largest platform in China), science and finance innovation servicing platform, and science and policy commercialization operating platform, CTE has satellite offices nationwide and 168 collaborating members. By the end of 2014, CTE has provided services covering 68,000 (valued RMB 98.5 billion) technology transfer projects and 9,816 technology contracts.

- CATTC (China-ASEAN Technology Transfer Center; www.cattc.org.cn): was jointly established by MOST (China), COST (ASEAN), and the science authorities of ASEAN member states to enhance the transfer of advanced and applicable technologies between China and ASEAN member states, thus to further the regional innovation integration.

- At the Province Level

- NTEM (Northern Technology Exchange Market; www.ntem.com.cn): was set up by Tianjing Municipality (also sponsored by MOST). Relying upon the internet platform, NTEM provides a bridge for technology transfer, and includes services for supplying information, matching technology and enterprise, consulting and managing technology assets, organizing technology convention and exhibition, transacting IP assets, and cooperating among international parties.

- STEE (Shanghai Technology Transfer & Exchange; www.stte.sh.cn): was set up by Shanghai Municipality in 1993. Similar to NTEM, STEE also provides a number of services with a focus on local institutions and enterprises and a far reach to international parties.

- At the Institution Level

- NTTAC (the National Technology Transfer of Chinese Academy of Sciences; www.ntt.ac.cn): under the Chinese Academy of Sciences (ACS).

- SJTUNTTC (National Technology Transfer Center, Shanghai JiaoTong University; www. sjtunttc.com): under Shanghai JiaoTong University, and supervised the National Development and Reform Commission and the Ministry of Education.

- Private Initiatives: Private investors have understood the interest and soundness of technology and invention exchanges and have implemented some initiatives. Between them, one may notice:

- TIPEI (Tianjing Binhai Intellectual Property Exchange International; www.tipei.net) TIPEI provides IP investment, financing and trading services. Established in 2011, TIPEI has strategic agreements with seven banks including Bank of China, China CITIC Bank. However, in May 2015, Vice President of TIPEI, YANG Weimin, expressed the difficulties in running TIPEI and indicated that there were not many deals done.12

- Ruichuan IPR Funds Ruichuan, founded in April 2014, is a complex organization with government involvement (Zhongguancun high tech District and Haidian District of Beijing), corporation investment (XIaomi, TCL, Kingsoft), and professional operation (Zhigu Corp., specialized IP service firm). The fund is expected to reach a few hundred millions (RMB).13 At this stage, Ruichuan could be more like IV. According to CEO of the company, ZHANG Hongjiang, the fund will focus on the technologies relating to mobile internet, cloud computing, and accumulate patent assets through acquisitions and investment in innovative projects and other channels.

We can also put in this category Intellectual Ventures (IV)—China—as long as it doesn’t take a litigious way as it did in western economy.

A Legal Endorsement

The 4th amendment in discussion to complete the Patent Law plans to insert a provision on Voluntary license (Articles 82-84), which will try to set up transparency and accessibility in patent licensing, as it reads:

“Patentee can make a statement before the administrative agency under the State Council to express its intention to voluntarily grant a non-exclusive license with a payment of certain amount of royalties Any potential licensee may take the license by notifying the patentee in writing and paying the royalties During the effective period of the voluntary license, the patentee should not grant an exclusive license nor request for preliminary injunction.”

It will be hazardous to predict the success of such a possibility (which exists for example in the UK patent law but has encountered few demands), but it is a strong sign that patents are not only considered as a protection net and a legal redress in China, but also as a technology transfer instrument and a valuation and transaction asset.

Forward-Looking

As the last report of McKinsey points out14 “China has the potential to build on its strengths in innovation and become a global leader—creating a “China effect” on innovation around the world.

Not only can China serve as the locus of innovation for a growing number of companies that want to penetrate China and other fast-growing emerging markets, but the Chinese approach to innovation also can spread, helping companies everywhere turn ideas into products and services more quickly and for less cost.”

Available at Social Science Research Network (SSRN) http://ssrn.com/abstract=2822298

- U.S. Embassy paper, http://beijing.usembassy-china.org.cn/iprpatent.html.

- Xiaolan Fu, “China’s Path to Innovation,” Cambridge: Cambridge University Press, (2015).

- Thomson Reuter, “China’s IQ (Innovation Quotient)”; http://ip.thomsonreuters.com/sites/default/files/chinas-innovation-quotient.pdf.

- SIPO Press conference 2015; http://www.sipo.gov.cn/twz-b/2015ndzygztjsj/.

- See note 3.

- Amcham China 2016 Survey report.

- European Union Chamber of Commerce in China, Business confidence survey, 2015.

- The State Council issued “Opinions on the acceleration of building up intellectual property power under new situation,” Guofa No. 71 (2015), December 22, 2015.

- Battelle, Global R&D Funding forecast report, 2014.

- Xiolan Fu, see note 2.

- China Daily, 2016-01-06.

- http://xianhuo.hexun.com/2015-05-22/176065000.html.

- http://news.xinhuanet.com/2014-04/26/c_1110426235.htm.

- McKinsey, “The China effect on global innovation,” October 2015.