les Nouvelles March 2021 Article of the Month:

Promoting Innovation Where Market Incentives Do Not Work

Adapted from a Panel Presentation at the LES USA & Canada 2020 Annual Meeting

Director

FasterCures

Milken Institute

Washington, DC USA

Chief Executive Officer

Sabin Vaccine Institute

Washington DC USA

Executive Director

Global Health Innovation Alliances Accelerator

Research Triangle Park, NC USA

Head of Collaborations, Deputy General Counsel

Coalition for Epidemic Preparedness Innovations

London, England

Special Counsel, Vaccines Legal Operations Innovation and Government Collaborations

Slaoui Center for Vaccines Research

Rockville MD USA

There are well developed paradigms for licensing new drug and biologic technologies in the biopharmaceutical space, based on widely understood principles for the development and commercialization of human therapeutics, vaccines, and medical devices that are subject to regulatory oversight. A typical license for an investigational therapeutic may involve upfront consideration, milestone payments that correspond to key inflection points in clinical development such as Phase I, II, and III clinical trials, and regulatory events such as filing of a New Drug Application (NDA) or Biologics License Application (BLA), and NDA/BLA approval by the relevant regulatory authorities. Typical license agreements also include earned royalties for a defined period, as measured from the date of regulatory approval, or based upon the terms of applicable patents, or a blend of these approaches. The financial terms of a typical biopharmaceutical license reflect the parties’ approach to modeling the anticipated future market for the technology. Many well understood and applied models that generate the net present value (NPV) and return on investment (ROI) of the technology in question assume that the future market includes populations of willing buyers and sellers over a defined, continuous period of time and a defined geography. The licensor assumes that sales revenue earned by the successful licensee will produce a royalty stream that satisfies the licensor’s expectation of the value of the technology. The licensee assumes that the volume of sales will be sufficient to recoup the licensee’s investment in the technology and in developing it to the point of regulatory approval. But what about situations where these expectations do not work?

Why Some Deals Are Different

Deals that do not fit the traditional structure typically address the needs of extremely small or extremely large patient populations, the latter often in less well-established markets. In the first, and sometimes less headline grabbing category are ultra-orphan and niche markets such as pediatric oncology (e.g., melanotic neuroectodermal tumors of infancy), rare genetic diseases (e.g., primary immunodeficiencies, mitochondrial diseases), and uncommon allergies (e.g., eosinophilic esophagitis).

The second category includes drugs, vaccines and medical products that should reach millions/billions of people but are needed only for a short time—even a single dose—or are needed by those in the least developed countries with little access to medical care. With the alarming rise of antimicrobial resistance (AMR) and spread of existing and new infectious diseases, new antibiotics and vaccines are desperately needed. However, an infectious disease market may take the form of an epidemic or pandemic and therefore be unpredictable or intermittent depending on whether the disease is active or not. This scenario has become increasingly familiar in the last 15 years as we have seen with the influenza H1N1 pandemic of 2009, the Ebola Zaire West African epidemic of 2014-2015, the Zika epidemic in the Americas of 2015-2016 and the ongoing, global 2020-2021 COVID-19 pandemic.

In each of the foregoing cases, traditional deal models based on milestone payments and earned royalties cannot be applied to determine the ROI because sales volume may be unreliable year-to-year, extremely low, or high but in markets unable to bear customary commercial terms. Nonetheless, the benefit to society may be substantial if one looks to the medical value of the licensed product in terms of lives saved, costs avoided, or to its indirect benefits in such areas as advancing development or lessening disease burden in least developed countries. These forms of benefit are hard to establish and are often not realized by individual market participants.

Other challenges faced by those wishing to engage in nontraditional biopharmaceutical deals are of a more technical nature: ultra-orphan diseases and neglected tropical diseases may attract less discovery research funding. If less is known about the disease and its natural history, the likelihood of scientific hurdles increases, leading to uncertainties in development. For example, it may be necessary to establish a new animal model or, in the case of a vaccine, to establish correlates of protection prior to initiating human clinical studies. Once in the clinic, the development path may be uncertain due to lack of established endpoints, or abnormally lengthy if there are difficulties in identifying trial subjects due to disease rarity. In other cases, such as countermeasures for biothreat pathogens, the development path may be abnormally short if the developer can take advantage of the U.S. FDA “animal rule” permitting emergency use authorization on the basis of safety and immunogenicity in human clinical trials coupled with a showing of efficacy in an animal model. Infectious diseases showing a pattern of sporadic outbreaks/epidemics may present other challenges since efficacy can only be measured in periods when the disease is active—and is impossible to measure if an outbreak has resolved.

In each of the foregoing cases, normal market incentives are not adequate to justify the development of the medical product. More of a “boost” is needed. This added incentive often includes either public money from government programs, e.g., the U.S. Biomedical Advanced Research and Development Authority (BARDA), the European & Developing Countries Clinical Trials Partnership (EDCTP), and/or global foundation and consortia money such as from the Bill and Melinda Gates Foundation (BMGF), the Wellcome Trust, or the Coalition for Epidemic Preparedness Innovation (CEPI). Social venture investors may also get involved. Each of these alternative types of ‘push’ funders bring different types of obligations (e.g., so-called ‘access to medicines’ obligations) as well as benefits in the form of nondilutive capital investment, sector knowledge, and credibility.

Challenges with Nontraditional Deals

When a for-profit company takes government, foundation, public development partnership (PDP) or other non-profit money, it must align its for-profit goals with those of the non-profit entity. Often the goals of the non-profit entity involve reaching small or poor markets in a sustainable manner; this may be reflected in so-called “access” requirements. Grantees and contractors engaged with the BMGF, Wellcome Trust, and CEPI, for example, must negotiate accommodations providing for additional licenses to be granted to third parties willing to fulfill the goals of the funding non-profit, or for second/additional manufacturers to supply the populations necessary for the non-profit to achieve its mission, or other similar policies.1 These policies and the deal terms that implement them may be modeled on the “march in rights” defined in the U.S. Bayh-Dole Act2 and its implementing regulations,3 which are required in U.S. government funding and the licensing of inventions developed by Federal laboratories. Briefly, a “march in right” is the right held by a U.S. Federal agency to require that a private sector IP holder grant a license to funded IP rights to a third party if the agency deems such action necessary to achieve “practical application” of the IP rights, or to alleviate health or safety needs not satisfied by the IP holder, or effect a preference for manufacture on U.S. soil.4 Indeed, the potential risk of loss of control over intellectual property may be the greatest challenge faced in nontraditional deals, leading private sector companies to forgo such deals altogether or to withhold their most promising technologies.5 Due consideration must be given, however, to the exceeding rarity of the exercise of “march in rights” by the U.S. Government when evaluating the risk to private sector IP.

While concern about “march in rights” has been expressed for many years, indeed since the passage of the Bayh-Dole Act in 1980, progress has been quietly made in the context of crafting negotiated solutions in individual deals that accommodate the concerns of each party to transactions between developers/funding recipients and non-profit funders. For example, the concept of a “Trusted Partner” may be introduced in which the parties agree up front on the identity of one or more third parties to whom the non-profit may direct that future licenses be granted, if necessary, to fulfill the non-profit’s mission. Permutations of this concept may include negotiating a stand-by license with a specific third party concurrently with the non-profit funding agreement or agreeing on criteria that must be fulfilled by a trusted partner to be identified in the future (e.g., the partner has adequate systems in place to protect trade secrets or it does not engage in business directly competitive with the private sector party). Concerns remain regarding whether the non-profit party will require the private sector party (if the licensee) to make long term commitments that might impact future profitability, money raising and manufacturing abilities. In most cases, though, these concerns are reduced when the actual contractual language is discussed, and each party’s needs are balanced.

A second significant challenge is the increased transparency that is often required by a non-profit or government funding partner. The partner often is governed by rules requiring disclosure of the use of any intellectual property arising from the funding. This may take the form of scientific publications or registrations in public databases such as www.clinicaltrials.gov. Alternatively, disclosure may be required to comply with state or Federal Freedom of Information laws. The private sector developer should be vigilant to take advantage of mechanisms in such laws for pre-disclosure review and redaction of trade secrets. The risk of disclosure may be heightened in nontraditional deal contexts due to the attention of a variety of new stakeholders, including watchdog organizations, taxpayer advocacy groups, and patient advocacy groups. Care must be taken to account for gaps in priorities, mission focus, culture (even including use of linguistic terms) and the resulting potential for reputational impact. Having a principled rationale for the specific deal and a more general strategy for addressing societal concerns such as global health, food insecurity, access to or cost of health care, along with a well-crafted public relations strategy, will go a long way to reduce public/media controversy by communicating the societal values served by the deal.

Another significant challenge may exist in the form of development or commercialization risk that is disproportionate to the foreseeable economic benefit. For example, the product’s revenue stream may be unlikely to cover potential product liability, or the necessary investment in specialized equipment, manufacturing facilities, or technology. Such concerns may be associated with manufacturing or quality requirements. Adverse events encountered by the developer or by a “Trusted Partner” may disproportionately impact the reputation or potential of the product. In the case of a platform technology, which can support high-value commercial products as well as a product covered by a nontraditional deal, the reputational impact of adverse findings in clinical (or even veterinary) development may exceed the market value of a nontraditional product. As with all deals, however, the parties need to acknowledge scientific risks as well as development risks in the negotiated terms of their agreement. These and other risks—perceived and real—may be addressed during contract negotiations of terms such as liability and indemnity, geographic restrictions, or requirements to qualify for protections afforded by specific laws, such as the U.S. Public Readiness and Epidemic Preparedness, or PREP Act.6

On a more practical note, many nontraditional deals will not succeed unless each contracting party has a dedicated champion who can communicate internally the benefits of doing the deal, and clearly articulate the hurdles anticipated and tactics for resolving them. The champion must be someone who has sufficient seniority or persuasive power to align the organizational resources necessary for success, including a cross-functional due diligence team, negotiating team and project team for the subsequent development of the technology. Challenges may also be encountered during internal governance processes; if the nontraditional deal does not fit neatly with established mechanisms or domains of authority, the champion may need to advocate directly to the C-suite or board.

Even when a company has made the decision to discontinue an asset for commercial reasons, there can be many barriers to externalizing that asset. There is a cost to preparing an asset for a new owner, and those costs may be perceived to be higher than the value to be recouped in a potential deal. In addition, resources are needed to catalogue project information related to the asset, but they may have been diverted to activities that better align with the strategic interests of the company. This can result in erosion or loss of information, data, and know-how. Cultural barriers within companies can exist as well. Incentives for business development professionals are frequently based on the assets they license in, not the assets they license out. There can also be a cultural mindset of “I would rather have 100 percent of something on the shelf than 20 percent of a blockbuster that somebody else develops.” Finally, the matching of promising assets to capital can be inefficient. Interested stakeholders like investors, nonprofit organizations, government, and smaller companies often do not have visibility into assets that have been discontinued by pharmaceutical companies and may be available for licensing. Correspondingly, lack of transparency on the reason for discontinuation (e.g., scientific versus commercial) may cause the market to inappropriately “taint” an asset.

Benefits of Nontraditional Deals

The need for deals of the type we define as “nontraditional” has become apparent in recent years, as societies face increasing scientific challenges to protect and advance human health. We face growing societal demands that more products reach more markets - including those that fail to operate according to the dynamics that have traditionally defined profitable deals: continuously available populations of willing market participants, a predictable development path, and sales revenues sufficient to meet licensee and licensor expectations of value. Nonetheless, nontraditional deals offer the parties and their representatives a number of organizational and individual benefits.

At the organizational level, the benefits of engaging in a deal outside of commercial market-defined norms may include a unique opportunity to benefit a patient population, perhaps one of strategic value and/or with an active patient advocacy group. This may provide a path to demonstrate the utility and breadth of a technology platform, as we have just seen in 2020 with the use of RNA-based vaccines for COVID-19. Such a deal may also serve to increase market channels by exploiting a neglected or niche market that provides a demonstration of a platform technology with broader potential. In either case, companies can demonstrate how they contribute actively to society rather than simply seek the maximum return on capital, and at the same time explore new ways of working or areas of interest that may add to their strategic agility in the longer term. Engaging in a nontraditional deal may also lead to value inflexion points for a product candidate or even validate a platform technology, as well as generate new scientific knowledge and intellectual property within the organization. Non-dilutive public or grant funding can also de-risk innovation or a shift in focus by reducing P&L impact. Such funding can also be used to bridge the ‘valley of death’ in development funding, thereby keeping a promising program on track without loss of ownership. Thirdly, the magnitude of the investment and the credibility of the funder may be such that the deal—or the due diligence performed—can validate the funded organization’s management team, supporting further investment.

For individuals involved in negotiating and drafting a nontraditional deal, as well as those subsequently involved in the collaboration or development activities, deals with nontraditional partners may offer several benefits. Reaching across a cultural divide between commercial market actors and mission driven organizations can bring positive energy and inspiration to individuals across a company, engaging them to advance their careers and job satisfaction, as well as the company’s business strategy and/or reputation. The deal team participants may also encounter unique opportunities for creativity in crafting solutions to the points raised in negotiations; this helps the transactors to develop deal skills that will be deployed in facilitating future commercial deals.

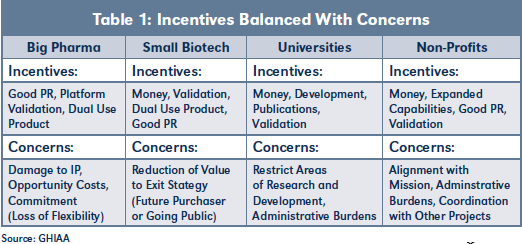

Table 1 provides an overview of typical incentives and corresponding concerns encountered when negotiating nontraditional deals. Experienced practitioners will recognize parallels with the restrictions and oversight typically required by private equity and venture capital investors.

Examples of Success Stories~

With Case Studies

Example 1: The Crisis of Antibiotic Resistance

The threat of antibiotic resistance is growing globally. In the U.S., there are 2.8 million drug-resistant infections annually.7 Yet there are not enough drug candidates in development to ensure a diverse and robust pipeline of drugs. An analysis from December 2019 found that there are currently as few as 41 candidates in clinical development.8

The lack of drug candidates is a function of both the scientific challenges of antibiotic drug development and the lack of profitability that currently exists in the antibiotic market, particularly when compared with other areas. Antibiotics do not fit the traditional pharmaceutical business model under which revenues are based on volume sales. The more antibiotics are used, the more resistance can develop. Containing the development of resistance is one of the core principles of good medical stewardship, but inevitably leads to use of novel antibiotics only in last-line clinical situations, with correspondingly low annual sales volumes. The bankruptcies of antibiotic developers Achaogen and Melinta Therapeutics illustrate these challenges.

Infex Therapeutics, formerly The AMR Centre, is a UK-based public-private organization that seeks to rebuild the pipeline of antibiotics. In 2019, Infex Therapeutics signed a deal with Shionogi, a Japanese pharmaceutical company for a drug to treat a bacterial infection commonly seen in people with non-cystic fibrosis bronchiectasis (NCFB), a neglected, chronic condition that affects 1.5 million people worldwide and that results in progressive respiratory decline following lung damage, for example, from tuberculosis or viruses like COVID-19. The Infex Therapeutics and Shionogi transaction highlights what is possible when pharmaceutical companies expand their potential partnership network to include nontraditional mission-driven players.

Case Study 1: Infex-Shionogi

In 2019, Infex Therapeutics signed a deal with Shionogi, a Japanese pharmaceutical company for a drug to treat a bacterial infection commonly seen in people with non-cystic fibrosis bronchiectasis (NCFB). NCFB is a neglected, chronic condition that affects 1.5 million people globally and results in progressive respiratory decline following lung damage, for example, from TB or viruses like COVID-19. About half of people with NCFB develop a chronic bacterial infection called Pseudomonas aeruginosa (Pa), which cause significant morbidity and mortality.

Despite impressive pre-clinical data, there was no clear route through clinical trials for Shionogi’s preferred indication in ventilator-acquired pneumonia. Working with its own scientific experts, Infex Therapeutics determined the potential of this drug as a treatment for Pa infections in people with NFCB. Infex Therapeutics formulated a clinical development plan for this indication, which led Shionogi to grant Infex Therapeutics exclusive rights to develop the drug until Phase II. Notably, Shionogi retains the option to license back and commercialize the program.

|

Example 2: A Disease Characterized by Unpredictable Epidemics

Ebola virus disease is one of the deadliest neglected tropical diseases, characterized by unpredictable outbreaks and periodic epidemics. In the recent West African epidemic of 2014-2016, over 28,000 people contracted Ebola and over 11,000 died. The world was not prepared for this large-scale epidemic despite having identified the virus as early as 1976 and knowing of its history of sparking deadly outbreaks. Despite longstanding scientific interest in developing vaccines, and even early-stage clinical safety studies (Phase I studies), it had been impossible to conduct clinical studies to assess efficacy and dosing (Phase II and III studies) due to the rarity of cases between outbreaks and the unpredictable occurrence and resolution of epidemics. Even in the West African epidemic, the largest and most sustained epidemic to date, several candidate vaccines were quickly deployed but only one (rVSV-ZEBOV) achieved completion of the clinical study process before the epidemic had resolved.

The West African epidemic was caused by the Zaire strain of Ebola virus; there is a distinct strain of Ebola called Sudan, and a closely related species called Marburg virus. Both share Ebola Zaire’s properties of high mortality and unpredictable outbreaks, and vaccines for both are considered a high global health priority. Both diseases occur in developing countries of Sub-Saharan Africa, although there is a potential niche commercial market for travelers’ vaccines. GSK had developed early-stage candidate vaccines for Ebola Sudan and Marburg while working in conjunction with investigators at the National Institute of Immunology, Allergy, and Infectious Diseases (NIAID) and with funding provided by BMGF. After the West African epidemic, GSK promulgated its new Global Health strategy based on three principles: programs that are science-led, sustainable, and prioritized for impact. This strategy proved an excellent fit with the recently refreshed R&D strategy of The Sabin Vaccine Institute: to advance vaccine candidates with demonstrated scientific value but little commercial value. Both parties had established scientific relationships with the NIAID. Negotiations culminated with the announcement of an asset transfer and license agreement in August 2019.9 Sabin subsequently secured significant nondilutive funding from BARDA to advance development of these vaccine candidates.10 This deal illustrates how a nontraditional deal can be a win-win for a mission-driven organization and for business sustainability.

Case Study 2: GSK-Sabin

Having developed its ChAd3 Ebola Zaire vaccine through Phase II clinical studies, GSK entered into agreements with the Sabin Vaccine Institute for Sabin to continue development of the program with an emphasis on Ebola Sudan and Marburg viruses. GSK provided Sabin with patents and certain assets related to these three pathogens, as well as all clinical data. Sabin is providing GSK with a grant back on certain IP and access to all data. A unique feature of the transaction was that neither party received upfront financial compensation. GSK leadership, which changed during the deal negotiations, remained committed to global health leadership through empowering its partners, notably Sabin and NIAID. The deal timeline was typical with expert business development and legal representation, who worked through challenges associated with liability protection and manufacturing know-how.

As a non-profit, grant-based, global health organization, Sabin had to secure funding to support the continued development of GSK’s program. Simultaneously with GSK deal negotiations, Sabin applied for and received a $128M funding commitment from BARDA in September 2019 to support further development of the Marburg and Sudan vaccines. GSK and Sabin have continued to work together after signatures and closing of this transaction, to assure the success of technology transfer. Transparent communications have been important throughout the process to tackle challenges; Sabin had to build infrastructure to receive data, and GSK had to assemble the data package more than one year after its internal project had been deprioritized and team members reassigned. Through the dedication of teams for both parties, all challenges have been resolved successfully. The project continues to progress, and as of January 2021, Sabin initiated a Phase 1 clinical trial.

|

Example 3: CEPI - A New Model for Nontraditional Partnering

There are few vaccine candidates for WHO priority pathogens.11 The timing and size of outbreaks and markets for these pathogens is uncertain and the main market is often in low- and middle-income countries, sometimes with scope for targeted high-income country markets. The Ebola outbreak of 2014-2016 demonstrated a clear need for the finance and coordination of the development of new vaccines to prevent and contain infectious disease outbreaks and in particular to ensure vaccine candidates were ready to be used in an outbreak where needed, enabling a path to assess efficacy and, therefore, to licensure. In 2017 the Coalition for Epidemic Preparedness Innovations (CEPI) was formed. CEPI’s mission is to both accelerate development of new vaccines and to enable access to those vaccines for those who need them. Its model is to do this in a way that acknowledges and works with traditional commercial approaches towards an end-to-end approach, bridging funding gaps and providing a longer-term funding path. By the time SARs-CoV-2 was identified, CEPI was supporting 18 vaccine candidates against five pathogens and three rapid response vaccine platforms. By 23 January 2020, CEPI had agreements in place to fund the development of three candidates against SARs-CoV-2.

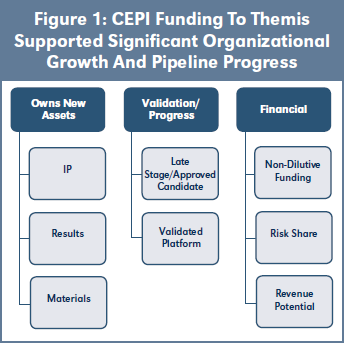

Three of CEPI’s vaccine candidates are being developed by Themis Bioscience. The goal is to take the early-stage vaccine candidates for Lassa12 and MERS through development to be ready for efficacy studies in an outbreak and to progress a late-stage Chikungunya candidate. As illustrated in Figure 1, CEPI funding to Themis supported significant organizational growth and pipeline progress. Commitments on the subsequent supply of resulting vaccines and publications were all sustainable for the company. This funding and CEPI’s due diligence and support were recognized as an influential positive factor in later investment rounds. The shareholders achieved an exit to Merck in 2020. See Case study 3 on page 7.

Case Study 3: CEPI-Themis

Themis Bioscience GmbH, a private Austrian company, was founded in 2009 with a focus on vaccines and immune-modulation therapies for infectious diseases and cancer. It licensed in measles vector technology from Institut Pasteur in 2010 and raised capital through Series A and B rounds of investment before receiving up to $37.5M in grant funding from CEPI in March 2018 to take vaccine candidates for Lassa14 and MERS based on Themis’ measles vector platform technology through development to be ready for efficacy studies in the event of an outbreak. CEPI funding is tranched according to development and equitable access milestones. Themis raised Series C round investment in 2018 in a round led by the Global Health Investment Fund (GHIF), a social impact investment fund, and a Series D round investment led in 2019. CEPI provided up to a further $21M in grant funding in 2019 for a late-stage Chikungunya vaccine candidate15 on the same platform. CEPI’s funding and support of Themis was cited as a validation of Themis as a candidate for venture capital investment. Institut Pasteur and Themis collaborated with the University of Pittsburg on a SARS-CoV-2 vaccine candidate in 2020 with CEPI funding. Merck & Company acquired Themis in June 2020.

|

Lessons Learned

Each of the foregoing examples illustrates the achievements that can be realized from entering into nontraditional deals. The mission driven partner can make significant advances in achieving key societal benefits, while the private sector partner can find solutions that help to realize its business goals and its social responsibility commitments. The challenges, however, cannot be underestimated: cultural gaps are real, as are differences in priorities and objectives. Creativity is needed to craft fit-for-purpose licenses and other agreements. Fortunately, key resources are being developed to support these unique, win-win deals.

Resources for Facilitating Nontraditional Deals

The recently launched GHIAA MAPGuide® (https:// ghiaa.org/mapguide-home/) is an annotated index of actual and template contractual provisions from publicly available and voluntarily contributed global health alliance agreements. It includes real-world examples from public sector, industry, nonprofit, philanthropic, and multilateral institutions and is a user-friendly tool that allows practitioners and policymakers to navigate content easily and to see how different agreements have addressed key issues. The MAPGuide® can be used to consider what types of issues may arise in public-private negotiations, to prepare for a negotiation, or to point to when two parties are trying to determine what a solution to a particular issue might be. This is an organically evolving resource for the licensing and transactions community; GHIAA expects to add additional examples and capabilities in the future.

To facilitate more nontraditional deals, FasterCures announced13 a pilot partnership with the Children’s Tumor Foundation and CureSearch for Children’s Cancer—two leading non-profit foundations with missions to accelerate the development of new therapies for treating pediatric cancer and rare disease—to create a neutral information and matchmaking forum to connect promising drug programs with new development and investment partners. This initiative takes a nonprofit approach to supporting biopharmaceutical companies in identifying new partners for drug programs that lack traditional market incentives. Learnings from this pilot are intended to inform similar efforts in other disease areas.

Key Takeaways and Conclusion

While traditional metrics to define the economic risks and benefits of biopharmaceutical business transactions will always remain important, there are alternatives that can define both financial and non-monetary consideration in support of deals that are not amenable to traditional ROI and NPV calculations. Nontraditional deals can be both rewarding and enriching. Such deals can advance important social and business missions, as well as the careers and skills of deal teams, by requiring creative approaches to deal structure and drafting solutions. In the past year, to address the pandemic of COVID-19 and other challenges, scientists have broken down historical barriers to discover and develop new drugs, vaccines and medical products to protect patients—from the very few to global populations—and now business transactions professionals must also look beyond business as usual and develop new paradigms for nontraditional markets.

- See Global Access (https://www.gatesfoundation.org/), “Wellcome’s Approach To Equitable Access To Healthcare Interventions,” and Enabling-equitable-access-to-COVID19- vaccines_26Jan-2021.pdf (https://cepi.net/).

- Codified at 35 U.S.C. § 200–212.

- 37 C.F.R. 401 and 37 C.F.R. 404.

- 35 U.S.C. § 203-204.

- Such concern is not limited to the U.S. or to NGO funding; see, “WTO|Intellectual property (TRIPS)–gateway.”

- Summarized, along with a listing of current Declarations and Opinions of HHS Counsel, at https://www.phe.gov/Preparedness/legal/prepact/Pages/default.aspx.

- https://www.cdc.gov/drugresistance/index.html.

- http://pew.org/1YkUFkT.

- “GSK Grants Exclusive Technology License For Clinical- Stage Ebola Vaccines To Sabin Vaccine Institute”|Sabin.

- “Sabin Vaccine Institute Receives $20.5 Million from BARDA with Potential of up to $128 Million to Develop Ebola Sudan and Marburg Vaccines”|Sabin.

- https://www.who.int/activities/prioritizing-diseases-for-research-and-development-in-emergency-contexts.

- Lassa fever is a disease endemic in West Africa associated with annual outbreaks. MERS, first identified in 2012, is a coronavirus that causes a severe respiratory illness and has been associated with a number of outbreaks in Saudi Arabia and neighboring countries. https://www.who.int/health-topics/ middle-east-respiratory-syndrome-coronavirus-mers#tab=tab_1 & https://www.who.int/health-topics/lassa-fever/#tab=tab_1.

- https://milkeninstitute.org/fastercures/announcement/new-initiative-pediatric-tumors.

- Lassa fever is a disease endemic in West Africa associated with annual outbreaks. MERS, first identified in 2012, is a coronavirus that causes a severe respiratory illness and has been associated with outbreaks in Saudi Arabia and neighboring countries. https://www.who.int/health-topics/middle-east-respiratory-syndrome-coronavirus-mers#tab=tab_1 & https://www.who.int/ health-topics/lassa-fever/#tab=tab_1.

- Themis’ vaccine candidate had already received US FDA fast track designation and PRIority MEdicines (PRIME) designation by the EMA.